Our Recommended BTC Casinos – April 2024

Native tokens

Native tokens  Top Gambling Site

Top Gambling Site  Huge range of sports betting markets

Huge range of sports betting markets

Trusted and known brand

Trusted and known brand  Many cryptos available

Many cryptos available

Low Min. Deposit

Low Min. Deposit  Large selection of games

Large selection of games  live chat support

live chat support

Large selection of games

Large selection of games  Popular cryptocurrencies accepted

Popular cryptocurrencies accepted  24/7 Support

24/7 Support

Crypto Casino

Crypto Casino  Live Casino

Live Casino  Provably Fair Games

Provably Fair Games

Fast payouts

Fast payouts  Provably Fair Games

Provably Fair Games  Great offers & promotions

Great offers & promotions

Generous welcome bonus

Generous welcome bonus  Large selection of games

Large selection of games  Crypto Casino

Crypto Casino

Easy site navigation

Easy site navigation  Easy registration

Easy registration  Easy & quick withdrawals

Easy & quick withdrawals

User-friendly platform

User-friendly platform  No KYC needed

No KYC needed  Many cryptos accepted

Many cryptos accepted

Top Crypto and Bitcoin Gambling Sites

- BC.Game – Best Overall Crypto and BTC Casino

- Stake – Best for Crypto Game Choice

- Bitcasino.io – Best for Regular Cashback

- Roobet Casino – Best for Free Spins Bonus

- JustCasino – Best for Low Minimum Withdrawal

- 7bit Casino – Best for Provably Fair Games

- RedDice Casino – Best for Regular Bonus Options

- Chipstars Casino – Best for Low Wagering Requirements

- DuckDice Casino – Best for Playing Dice Games

- BetPlay Casino – Best for Gambling Anonymously

10 operators made it on our list after our experts reviewing over 80+ crypto casino sites. Our casino experts will divulge into more details on these gaming sites below.

1. BC.Game – Best Overall Crypto and Bitcoin Casino

BC.Game is an impressive crypto casino which opened its doors in 2017, giving it plenty of time in operation. If you want free bonus crypto, it’s an excellent option. There’s a Curacao license and a substantial selection of games, ensuring it’s one of the top sites in the industry. At BC.Game, fiat-to-crypto conversion isn’t supported; you can only view your crypto balance in fiat currency equivalents. While this casino hasn’t released an app yet, the website is fully compatible with mobile screens.

Pros

- The daily bonus wheel provides free crypto chances

- An amazing choice of casino games

- Provides an innovative welcome bonus

- Has a high-quality choice of cryptocurrencies

Cons

- The wagering requirements are some of the biggest on the market

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| Up to 270% and 1 BTC | 500x the bonus amount | 0.0001 BTC | 10+, including BTC, ADA, BCH, ETH, and more |

2. Stake – Best for Crypto Game Choice

Stake takes its place near the top of the crypto gambling market, partly due to the incredible choice of software developers it features. If you want to enjoy a vast range of casino games, Stake is the site for you. With over 5,000 games, it’s perfect for players searching for choice. While fiat conversion isn’t currently supported at Stake, you can still view cryptocurrencies in fiat values. Unfortunately, there is no Stake mobile app available for Android or iOS. However, the site functions smoothly on smartphones through web browsers.

Pros

- Many different crypto bonuses

- Over 5,000 casino games

- Lots of sporting events available for staking

- New welcome bonuses appear often, making it appealing to a range of users

Cons

- There’s a seven-day limit on wagering

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| Lots of regular bonuses | 40x with a 7-day limit | Varies for each crypto | 8+, including BTC, BCH, TRX, XRP, BNB, ETH, LTC, and DOGE |

3. Bitcasino.io – Best for Regular Cashback

There’s a substantial choice of gambling opportunities with Bitcasino.io, covering everything from slots to table games. If you want to add cashback to your account, Bitcasino.io has excellent options in place. It adds additional promotions to make this a casino with lots to offer to players looking to boost their bankroll. Bitcasino.io allows players to directly purchase coins using fiat, however there’s no option for conversion. Players can download and install the Bitcasino.io app for Android for optimal mobile gaming, but there’s no app available for iOS yet.

Pros

- Massive choices of casino games are available

- Lots of markets for sports betting in place

- Provides regular opportunities for cashback

- An excellent VIP program is available at Bitcasino.io

Cons

- No standard welcome bonus

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 20% cashback up to 10,000 USDT | No wagering requirements | 0.0001 BTC | 8+, including BTC, BCH, BUSD, ETH, LTC, and DOGE |

4. Roobet Casino – Best for Free Spins Bonus

Roobet is a pure crypto casino, ensuring players who love to remain within the crypto ecosystem can do so. If you want to add free spins to your bankroll, Roobet provides 70 spins to players. There’s plenty available on this site, making it well worth taking a close look. The casino is a dedicated crypto platform, so the site doesn’t support fiat conversion. At the moment, you can’t install a Roobet app as none is available. The casino still delivers an impressive mobile experience with a responsive and fast-loading site.

Pros

- Covers a solid selection of casino games

- Provably fair games are available

- There are no wagering requirements on the free spins bonus

- Surveys available to earn extra funds

Cons

- No matched bonus in place

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 70 free spins worth up to $70 | No wagering requirements | $10 | BTC, ETH, & LTC |

5. JustCasino – Best for Low Minimum Withdrawal

Justcasino.io is an extremely impressive crypto casino. If you’re searching for a low access point for withdrawals, this site has one of the lowest in the industry. It makes it extremely appealing to smaller players with a less substantial bankroll. While you can purchase coins at JustCasino using fiat, you cannot convert or maintain a fiat balance. The platform includes an optimized mobile site for seamless access on smartphones, but there’s no downloadable app available.

Pros

- A significant selection of casino games

- A crypto welcome bonus is offered

- Has one of the lowest minimum withdrawals on the market

- Provides provably fair games to players

Cons

- No information about its VIP program

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 100% matched deposit up to $500 & 100 free spins | 40x within 7 days | 0.0001 BTC | 10+, including BTC, BCH, and BUSD |

6. 7Bit – Best for Provably Fair Games

7Bit is an excellent crypto casino giving players access to a substantial welcome bonus of up to 1.5 BTC on the first deposit. If access to provably fair games is on your list of requirements, this is the site to try. It provides a fantastic range of crypto gambling options, so is appealing to crypto users. Like most other btc casinos, 7Bit only supports buying coins with fiat. Players are unable to convert crypto to fiat and vice versa. Our review confirms that 7Bit Casino performs favorably on mobile browsers, but an app isn’t available.

Pros

- Lots of superb provably fair games

- A large welcome bonus, including free spins

- Almost 5,000 casino games

- 7Bit features an excellent VIP program

Cons

- Not a large choice of cryptocurrencies

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 100% matched bonus up to 1.5 BTC and 100 free spins | 40x | $10 | BTC, BCH, ETH, LTC, BUSD, & DOGE |

7. RedDice Casino – Best for Regular Bonus Options

Despite what the name suggests, RedDice isn’t just a dice gambling site. If you want to add many extra bonuses to your profile, RedDice has a substantial range of extra bonuses available to players. With a top-class range of games available, there’s something for everyone at this crypto casino. This gaming site lets you deposit and maintain your balance in fiat currencies, but there’s no option to convert fiat to crypto directly. The casino doesn’t feature an application yet, but you can seamlessly use the mobile site on your smartphone.

Pros

- Provides plenty of casino games for users

- An excellent welcome bonus is in place

- The welcome bonus has fair wagering requirements

- Many regular bonus choices available

Cons

- Withdrawal fees of $3

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 200% matched deposit up to $1,500 | 30x | $30 | BTC, BCH, ETH, & LTC |

8. Chipstars – Best for Low Wagering Requirements

After starting operations in 2020, Chipstars has built an excellent name for itself in the crypto market. If you want low wagering requirements on an initial bonus, Chipstars has a 1x rollover in place. Adding a license from Curacao makes this an extremely trustworthy option for players. This platform supports fiat and crypto payment options, although players can’t convert from digital coins to fiat. With Chipstars Casino, you enjoy an intuitive mobile site, although the platform has no downloadable application.

Pros

- Superb choice of different bonuses

- A big choice of casino games

- Low wagering on the welcome bonus

- Regulation from the Government of Curacao

Cons

- The minimum deposit is quite high

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 100-270% up to $36,460 | 1x | $30 | 10+ including BTC, BCH, ETH, DOGE, ADA, and more |

9. DuckDice – Best for Playing Dice Games

Dice lovers will love what’s available at DuckDice, featuring a varied selection of dice gambling options. If you like to roll the bones will instantly find this an appealing casino. The bonus options add to the overall experience, ensuring there’s a selection of ways to boost the bankroll. This gaming site has a built-in currency converter, but it only supports crypto coins. You can’t exchange fiat money. DuckDice is yet to release an app for players. As a player, you can still use the mobile site conveniently.

Pros

- Many different dice gaming options

- A welcome bonus of up to 2 BTC is available

- Plenty of different gambling methods in place

- Players can enjoy daily bonus games to get extra boosts

Cons

- The wagering requirements aren’t clear and open

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 100% up to 2 BTC | Unknown | 0.0001858 BTC | 30+, including BTC, BNB, BCH, SOL, XMR, LTC, ETH, and more |

10. Betplay – Best for Gambling Anonymously

Betplay provides instant payouts and an excellent selection of provably fair titles, instantly helping it to stand out on the market. If remaining anonymous when playing is critical, Betplay provides the opportunity. Users can add a superb welcome bonus to their account, making it even more appealing. BetPlay doesn’t support fiat-to-crypto conversions. On the platform, players can only use fiat to buy crypto coins. Players at this casino can enjoy the platform’s responsive UI on mobile browsers. But there’s no application to download.

Pros

- Anonymous betting is possible at Betplay

- Users can instantly withdraw their funds

- A massive selection of casino games

- The VIP scheme is superb

Cons

- The wagering requirements are extortionate

| Crypto Bonus | Wagering Requirements | Minimum Deposit | Available Currencies |

| 100% bonus of up to 50 mBTC | 80x | N/A | BTC, DOGE, BNB, TRX, ETH, USDT, XMR, USDC, SHIB, SAND, XRP |

What is a Bitcoin Casino?

A Bitcoin casino is a gambling site where players can use BTC as a payment method. In the modern world, a BTC casino can refer to sites which accept other cryptos.

Although this isn’t completely accurate, it’s a colloquialism used by people who don’t fully understand crypto.

Crypto sites are growing considerably, and grab increased market share year-on-year.

It makes it a fast-growing facet of the gambling industry, which with the impressive nature of crypto gaming holds the potential to be a driving force for innovation moving forward.

Pros & Cons of Playing at a Bitcoin Casino

- Pros

-

Rapid access to funds when withdrawing

Rapid access to funds when withdrawing -

Lower costs for international transfers

Lower costs for international transfers -

Potential to remain anonymous, increasing privacy

Potential to remain anonymous, increasing privacy -

Extreme levels of security and safety

Extreme levels of security and safety

- Cons

-

Not as widespread as traditional casinos

Not as widespread as traditional casinos -

Some jurisdictions have strict laws on crypto gambling

Some jurisdictions have strict laws on crypto gambling -

The volatility of crypto can lead to larger losses

The volatility of crypto can lead to larger losses

How Do We Select the Best Crypto Gambling Site?

There are many factors that we take into account when selecting the best Bitcoin casino. However, our top 9 points give users a simple breakdown of the essential aspects.

1️⃣ Reputation and Licensing

2️⃣ Geo-restrictions

3️⃣ Cryptocurrencies Available

4️⃣ Game Selection

5️⃣ Bonuses and Promotions

6️⃣ Payment Options

7️⃣ Fair Gaming Conditions

8️⃣ Mobile Compatibility

9️⃣ Top Customer Support

Reputation and Licensing

We look into the reputation of a casino as it provides extra trust to a site. If it behaves fairly, users will speak well, ensuring its reputation matches its actions. The addition of a license ensures that you can trust the site to be lawful.

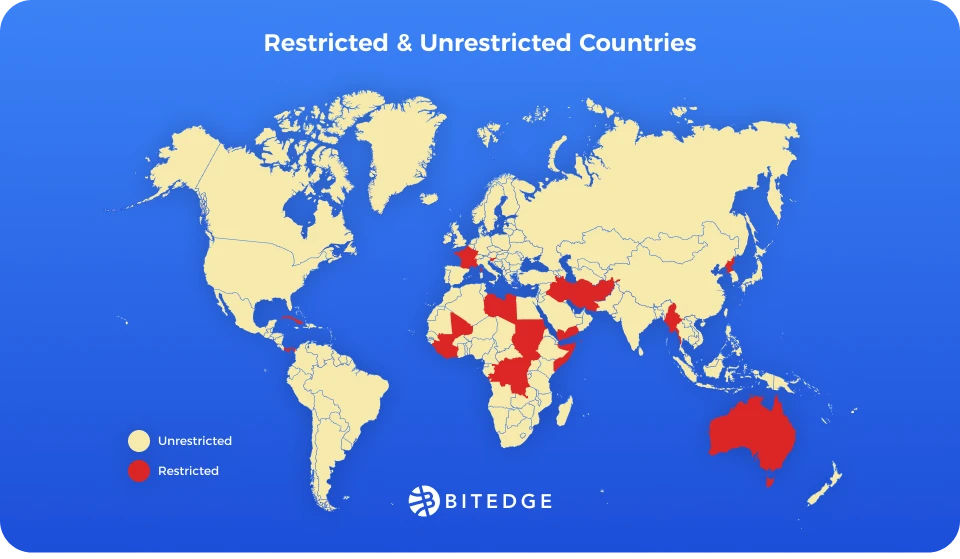

Geo-restrictions

It is essential for us to check the geo-restrictions of each platform. If the site doesn’t allow players from a specific country it will impact legal play. Although a VPN can get around restrictions, it provides further risk which many players want to avoid.

Cryptocurrencies Available

It’s critical for us to select a casino that have all the cryptocurrencies available. Signing up to a casino with a wallet full of ADA only to find it only accepts BTC will put up barriers to play. So, this will help to reduce costs and ensures players can get into the games sooner.

Game Selection

Before selecting a casino, we ensure that each platform has all the best games available for players before signing up. Players looking for provably fair games will want access to them, slot enthusiasts will seek out the best slots, and table game players will look for the top Blackjack options. The lack of access to favored games can ruin the experience, so it’s vital for us to consider this aspect.

Bonuses and Promotions

It is crucial for us to examine the available promotions and their terms at each and every casino before selecting a site. Adding a boost to the bankroll is common in modern gambling. Anyone looking to increase their budget, must ensure the bonus is generous and fair.

Payment Options

A number of players prefer withdrawing with fiat. Hence, not all crypto platforms provide this option, so we always ensure that fiat withdrawal options are available while selecting the casino.

Fair Gaming Conditions

Ensuring fairness is a critical aspect for us, not just for the best crypto casinos. We make sure that the site behaves fairly by checking their wagering requirements, time limits, withdrawal conditions, and anything else related to gambling.

Mobile Compatibility

Mobile gaming is the fastest-growing demographic in gaming. For this reason, we assess whether every casino is mobile compatible.

Top Customer Support

To ensure that players have a smooth gambling experience, we check the level of support that each casino offers. Even the best sites sometimes encounter issues with service. Without high-quality customer support, there’s no way to resolve issues when they arise. That’s why we ensure that the listed casinos have the best customer support available.

How We Rate and Review Casino Sites

We assess and evaluate new crypto casino sites by analyzing 10 different factors:

👥 Anonymity

Remaining anonymous is critical for many crypto gamblers. Part of the appeal of decentralized finance is the opportunity to retain privacy. It’s not possible at all Bitcoin casinos, so we cover this detail to give players the full facts.

🔑 Accessibility

Is the site accessible? It doesn’t matter how good the features are if the site is hard to use. Loading speed, platform support, and user-friendly navigation all go into our rating on accessibility.

📈 Fees & Limits

Fees for transactions can eat into profits. It’s a negative which can impact how enjoyable a site is. Withdrawal limits are another aspect which impacts on player enjoyment, if the site limits access to winnings, it’s a definite negative. We are transparent about fees and limits to fully prepare users.

💸 Payouts Speed

Crypto payments are instant, so when a site adds its own processing time it diminishes the quality of the casino. We check payout speeds so players know what to expect.

🎲 Game Selection

We always review the standard of game selection. Players know if their favorite titles are in place before signing up, ensuring users can find the best casino for their desires.

🔒 Security & Fairness

It doesn’t matter what a site offers if it isn’t secure. The same concept applies to fairness. As a result, we take pride in checking how safe and fair a crypto casino is. Players know our recommended sites have the highest security protocols in place.

🖼️ User Interface & Design

While classic design sites lean into the retro look, they’re not always easy to use. Our reviews cover the level of design for a casino. If it isn’t user-friendly, we always let our players know.

₿ Secure Crypto Payments

Crypto payments have excellent security in general, but if the site has flaws it can impact payments. We check there’s encryption in place so players have full protection.

🧾 Licensing & Accreditation

Although a license isn’t a necessity, it’s still positive to see one. We list all licenses and other accreditations to ensure players understand what to expect.

💰 Bonuses, Promotions & Wagering Requirements

A bonus isn’t as simple as the amount available. The terms and conditions impact on its quality. We cover all aspects of bonuses and promotions so players can ascertain if it’s a fair offer.

Our Choice for the Best Crypto Casinos in 2024

Types of Bitcoin and Crypto Bonuses

| Welcome bonuses | A reward for signing up to the site is typically available with the first deposit players make. These are often a matched deposit, which awards a percentage match as bonus funds. An example is a 100% welcome bonus, which adds a $300 bonus when making a $300 deposit. Welcome bonuses can offer free spins as part of the package, but it’s not always the case. |

| Deposit bonuses | Adding a deposit bonus to an account normally comes after players claim their welcome bonus. Often known as a reload bonus, it will typically provide a matched deposit but at a lower percentage than the welcome offer. So, users can get 50% match bonuses on further deposits. As a result, a $300 deposit will get $150 on top as a bonus. These bonuses can provide free spins as part of the promotion, but it’s not always the case. |

| Free spin bonuses | A free spin bonus provides players with spins for video slots. They can be from a deposit, as a free promotion, or as VIP rewards. These are typically low-value spins, with up to 500 available. |

| No-deposit bonuses | A no-deposit bonus is exactly what the name suggests, a bonus without the need for a deposit. These bonuses are typically a small amount of free spins with wagering requirements. However, they can be bonus cash, which has wagering requirements attached to them. |

How to Choose a Bitcoin Betting Bonus?

With so many Bitcoin bonuses available, users must follow our six tips to find the right promotion.

1. Time Limits for Wagering

A time limit on wagering requirements can make or break a bonus. If players only have a week to complete wagering, it can make it impossible to achieve. As a result, it’s critical to check there are no over-the-top time limits before claiming any bonus.

2. Welcome Package

A solid welcome package is appealing when signing up to a new casino. However, there are varying levels of bonuses available. For example, if the bonus has a poor percentage match, no free spins, or unfair wagering requirements, it won’t cover what users want. So, before signing up to a new casino, make sure to check the welcome promotions.

3. Roll-over Requirements

The rollover, or wagering requirements, cover how many times players must wager their bonus before they can make a withdrawal. For example, a 40x rollover means a 0.1 BTC bonus requires 4 BTC of stakes before players can make a withdrawal. Some sites can require over 60x wagering, making them much less fair than other operators.

4. Maximum Bonus Winnings

Another restriction placed on bonuses comes in the form of maximum wins. It’s most common with free spins, with them having a maximum amount available through the spins. It can make a bonus unappealing, especially for users who are looking to make the most of their bankroll boosts.

5. Types of Eligible Games

Eligible games vary in two distinct ways. Firstly, not all games provide the same amount towards wagering. An example of this is the difference between video slots and table games. A slot will count 100% of the stake towards the wagering requirements, but Blackjack typically counts around 10%. The second example is games which are completely ineligible for wagering. Some jackpot games and live dealer games won’t count towards wagering.

6. Maximum Percentage of Stake

This pertains to the amount players are allowed to wager. For example, each spin of a video slot will only allow 0.1% of the bonus as its stake. Not all casinos will have such a low percentage stake, so players can shop around to find one which matches their requirements best.

VIP Programs

One of the top benefits of playing at the best Bitcoin and crypto casinos is the VIP programs available. These are exclusive programs you join after using the site for a while and accumulating points. The more you play, the more points you gather and the higher your VIP rank. You’ll unlock more exclusive benefits as you reach higher loyalty levels.

Below are some of the main perks of joining casino VIP programs:

1. Tailored Bonuses and Promotions

These are usually deposit match bonuses, cashback, and free spins, but with a much higher value than regular ones. You can also get exclusive invitations to tournaments with huge prize pools.

2. Higher Limits

With this perk, you can deposit and withdraw larger amounts than non-VIP players. The best casinos will optimize payout times as well.

3. Dedicated Account Manager

Most VIP programs provide you with a personal point of contact to help you manage your account. They’ll assist in areas like customer support, withdrawals, and gaming recommendations.

4. Access to Exclusive Events

When you reach the highest VIP levels, you can get private invitations to real-world special events. Most BTC casinos offer loyal players fully paid trips to luxurious locations or invites to exclusive parties, concerts, sports matches, and other occasions.

You can enjoy the above benefits and more at the crypto casino sites we recommend.

New Crypto Casinos – April 2024

Our experts continuously seek out top-tier new crypto casinos that provide great benefits and excitement for our players. Each month in this section, we’ll showcase the latest casinos that have earned a spot on our list.

How Do Crypto Casinos Differ From Traditional Casinos?

The main difference between a crypto and a traditional casino is the ability to pay with cryptocurrency. It provides greater levels of security, faster transactions, and varying levels of anonymity.

Users can access funds faster, it reduces waiting time, making crypto much more convenient.

The potential anonymity and excellent security make it one of the most trustworthy ways to gamble. Although some sites operate without a license, there are still methods to test if a site is trustworthy.

The volatility of crypto can impact its use, but it has the potential to increase in value, so it’s not always a negative.

- Pros

-

Rapid withdrawals are available

Rapid withdrawals are available -

Financial and personal anonymity is possible

Financial and personal anonymity is possible -

High levels of security with crypto payments

High levels of security with crypto payments

- Cons

-

Not all casinos provide crypto access

Not all casinos provide crypto access -

Some crypto sites don’t have a license

Some crypto sites don’t have a license -

Crypto volatility can impact the value

Crypto volatility can impact the value

What Types Of Games Are Available at a BTC Casino?

There are many games available at Bitcoin casinos. Players looking to begin gamble can find the following options.

Video Slots

The most popular casino game, slots are a modern reworking of classic fruit machines. The Megaways games are an example of popular slots.

Table Games

These are classic casino games. Titles such as Roulette, Blackjack, and Baccarat come under this banner. They’re available at most casinos.

Live Dealer Games

Generally, live dealer titles provide a video stream of a real-life dealer. They allow users to enjoy a more immersive experience. However, there are other live dealer games which provide a game show style title. Dream Catcher is the most famous of these releases.

Provably Fair Games

Created using blockchain technology, provably fair releases allow gamblers to check the statistical fairness of a game in real time. Crash games are a great example of a provably fair option.

Are BTC Casinos Legal?

It depends on the jurisdiction. However, as long as there are no restrictions on gambling or cryptocurrency, then crypto casinos will be legal. Many sites list any restricted countries in their terms and conditions, but it’s always a good idea to do your own checks for the area you reside.

There’s no direct federal restriction on online gambling in the USA. However, each state has its own laws for gambling online. Crypto users have to pay taxes on capital gains in the USA. The regulation is currently minimal, but as new laws emerge there is room for change.

Gambling is regulated by the UKGC in the UK. It’s one of the strictest regulators and ensures there are many protections for players. The regulation of crypto is minimal in the UK. Although, KYC has seen an increase recently.

Players can access online gambling in Canada without any problems. It’s legal and as a result, crypto casinos are common. There’s a superb range of sites available, with the government making it legal in 2021.

Online gambling is a grey area in India. Although gambling is banned, strictly speaking, there is no mention of online gambling in any legislation. There’s no gambling regulation for online gambling in India. The regulations for crypto gambling are lenient.

The perception of crypto has changed over the last decade. As understanding increases, more people see it in a positive light. With crypto gambling sites showing excellent levels of stability and security, it is becoming one of the most significant niches for online gambling.

Regulatory Compliance

The Bitcoin and crypto casinos we review are compliant with regulatory requirements. They hold valid iGaming licenses from bodies like Curacao eGaming and the Malta Gaming Authority (MGA), which enforce strict regulatory rules. Platforms that wish to obtain licenses must prove they are safe and secure. As a result, you can rest assured that you’ll get transparent and fair game results and protection for your personal and financial information.

Social and Community Features

Playing casino games while socializing amplifies the fun. You get that with the crypto gaming sites on our top list, which feature real-time chat rooms and forums. Via these platforms, you can interact with other players anytime, building a sense of community.

In the live chat rooms, you can discuss gaming activities and exchange updates and strategies with other users. If you have questions or inquiries, you can also share them to find solutions. The rooms are usually open to all players, so you don’t miss any vital information.

Some BTC casinos we recommend also have tournaments with live leaderboards. You play against other players to reach the top and claim notable perks. Not only are such tournaments ideal for building community relationships, but they also introduce an element of competition to your casino gaming experience.

Are You New to Crypto Casinos? Here’s How to Sign Up

Any players looking to begin the crypto gambling process can find out how with our step-by-step guide.

| Step 1️⃣: Use our toplist to find the most suitable crypto casino |

| Step 2️⃣: Tap the registration button located on the homepage |

| Step 3️⃣: Complete the signup process |

| Step 4️⃣: Connect to a crypto wallet and make a deposit. After the deposit clears, users can begin playing. |

| Step 5️⃣: Find the game you want to play, load it up, select a stake, and begin playing. |

💡 Tip: When signing up, always check the terms and conditions for bonuses

How to Make a Bitcoin Deposit at an Online Casino?

Funding your account at a Bitcoin casino is straightforward. Based on our experience after reviewing multiple crypto gaming sites, below are the usual steps involved:

| 1️⃣Log into your casino account and navigate to the Deposit section |

| 2️⃣Select your preferred cryptocurrency (BTC or any other coin) |

| 3️⃣Copy the casino’s wallet address |

| 4️⃣Switch to your crypto exchange wallet and select the option to transfer coins |

| 5️⃣Paste the casino’s wallet address in the receiver’s section and enter the amount you want to deposit |

| 6️⃣Approve and confirm the transaction |

💡 Tip: Deposits using crypto are generally instant. After you authorize the transaction, switch to your casino account and check if the money has been added to your balance. If yes, you can start playing your favorite games.

Why Is Gambling with Crypto Becoming Popular?

Gambling with Bitcoin and other cryptos is becoming popular for a variety of reasons, but three stand out from the crowd;

- The speed of payments is highly appealing. Users can access their funds much faster than fiat payments, making it more useful.

- The fees for transfers across countries are much cheaper, saving money for players on a tight margin.

- The ability to remain anonymous allows players to retain their privacy.

What Are the Current Trends in the Crypto Gambling Market in 2024?

Trends continually change in the crypto market, making for constant evolution and innovation. As a result, it makes it the most interesting industry in the world. At the time of writing, current trends are geared towards improving the gambling experience for punters.

There’s a drive to offer more games, access to more cryptocurrencies, improve bonuses, and make use of crypto influencers. The last trend is the most vital, as crypto influencers are becoming more prominent in the space.

Educational Resources

Beyond the fun and games, reputable crypto iGaming platforms have helpful resources to help you become a better player. Below are the primary options you can expect:

Responsible Gambling

This involves keeping your gambling activities in check to avoid going overboard. At the sites we recommend, you’ll get responsible gambling tools for setting deposit, session, and loss limits, time breaks, and self-exclusion.

The platforms also provide details for contacting responsible gaming organizations like GamCare, GamblingTherapy, and Gamblers Anonymous.

Understanding Blockchain Technology

Many new Bitcoin casino players find crypto and blockchain somewhat complex. For this reason, the best sites have resources to help users understand how the technology works.

You’ll usually find links to pages explaining the basics and intricate aspects of blockchain in the website footer. Some casinos also deliver real-time coin prices to update users on market volatility.

Why is Bitedge the #1 Source for Crypto Enthusiasts?

- We employ over 12 experts to review and list the best crypto casinos for our players.

- We continuously striving for improvement, we collect feedback from actual crypto players to enhance our platform.

- We received over 200 applications from new casinos to be listed on our site, only 15 made the cut after careful assessment to ensure they met our high standards.

- In 2023, we had approximately 4.5k sign-ups through our platform.

- We ensure that the site is always up-to-date to meet the needs of our users.

Final Thoughts

With so many crypto casinos popping up, it is challenging to choose the right one. However, we have put together the finest guide to sifting through the options and landing on a top-class choice. As BTC gambling sites increase in popularity, more will continue to appear, so it’s critical to follow our steps to get the most from your crypto.

As Bitcoin casino sites head towards becoming the most popular on the market, our guide covers the multiple advantages, plus what to expect from the best crypto gambling sites.

We believe crypto casinos will grow to become the standard bearer for the industry, so we always provide the best information to remain informed.

Our top picks

FAQs

Our toplists only include crypto casinos which are legitimate. We never recommended crypto casino sites with poor reputations. So, if it’s one of the best BTC casinos on our list, it’s a legitimate site.

As long as the site has adequate security in place, it will be safe. This comes in the form of SSL encryption and secure login features. Secure payment systems are another vital aspect. We only recommend secure sites, so our toplist is an excellent way to find a safe BTC casino.

As long as the site features Bitcoin as a payment method, then players can withdraw BTC from the site.

Biggest is a subjective term, but currently BC.Game and Cloudbet are two of the biggest crypto casinos in the online gambling industry.

More Crypto Casinos:

Will Wood

Author

A pro gambling writer since 2015, immersed in the world of crypto since 2016. I've built up a wealth of knowledge and experience in both crypto gambling and crypto betting, making me one of the most prominent voices in the industry.

More by Will Wood

Reviewer

Nakul Shah