What Is Polymarket?

Polymarket is the world’s largest prediction market, which lets you stay informed and profit from your knowledge by betting on future events and multiple topics. It reflects accurate, unbiased, and real-time probabilities for the events that matter most to you.

How Crypto and USDC Are Used for Betting on Polymarket?

The platform is powered by USDC and blockchain technology, allowing you to engage in crypto sports betting by placing on-chain YES/NO bets using a stable asset pegged to the US dollar.

Smart contracts automate trade execution and settlement, eliminating intermediaries and reducing third-party risks.

Additionally, Polymarket utilizes trusted external data sources, i.e., oracles, which resolve market outcomes and ensure verifiable results, fast payouts, and on-chain audits.

Why Polymarket Uses USDC for Betting?

There are a few reasons why Polymarket uses USDC instead of volatile cryptocurrencies, such as:

Stable value bets: USDC maintains a 1:1 value with the dollar, providing price stability that eliminates crypto volatility. You can benefit from better prediction accuracy without market fluctuations.

Faster settlement: As the blockchain-based USDC transactions use smart contracts, they enable nearly instant payouts.

Lower transaction fees enabled by blockchain infrastructure: Ultimately, blockchain fees are much lower than those of traditional payment methods, due to the lack of any intermediaries.

How Polymarket Differs from Traditional Betting?

Traditional betting works with a central “house” controlling odds and payouts. Compared to it, Polymarket has a decentralized approach, where users determine odds and smart contracts handle all payouts. Here are some of the main differences:

1. Decentralized Payouts and Automation

Polymarket uses smart contracts, a self-executing code on the Polygon blockchain. After you place a bet, your money is held in an escrow-like contract, not held by a company. This way, there’s no risk of a platform refusing to pay or going bankrupt and taking all your money with it.

2. Market-Driven Pricing:

The odds are set from collective trading activity – not being set by a House, like in traditional sportsbooks; as traders buy and sell YES/NO shares at different prices, the demand is pushing prices up or down and reflecting the market’s belief about the likelihood of an outcome.

3. Transparency:

Event rules are clearly defined upfront, creating a transparent betting environment; every price change, volume spike, and single trade is recorded on a public ledger. This transparency shows how much money supports a specific outcome and verifies fair platform operations without relying on internal audits.

Polymarket vs Sportsbooks and Poly Bets

| Polymarket | Traditional Sportsbooks | |

| Fund Custody | You can keep funds on-chain via smart contracts using USDC | The bookmaker holds and controls the funds |

| Exiting Positions Early | You can exit a position anytime by selling YES/NO shares | Early cash-out is either limited or unavailable |

| Odds Flexibility | Odds are market-driven and adjust in real-time based on demand | The sportsbook sets and manages the odds |

| Regulatory Oversight | Operates under different or limited regulations (depending on the jurisdiction) | Fully licensed and regulated by gambling authorities |

How Does Polymarket Betting Work

Polymarket functions as a betting model where odds are formed by market activity rather than by a bookmaker, and prices change based on supply and demand.

This matters for bettors because odds show the real-time collective beliefs, allow you to exit a position early, and remove the need to rely on a central house to manage pricing and payouts.

Yes/No Markets and Outcome Shares

Most Polymarket bets are binary (Yes or No). This means that you bet on whether an event will happen, such as “Will TikTok be restricted for children under the age of 16 in the US this year?”

- Buying a share represents a bet on that outcome, and only one side settles at $1.00, i.e., the side that picked the correct outcome.

Polymarket Betting Odds – Prices and Probability

On Polymarket, each YES/NO share is priced between $0.01 and $1.00. This price actually represents the market’s implied probability of that outcome.

- For example, a $0.60 YES share suggests there’s a 60% probability of the event happening.

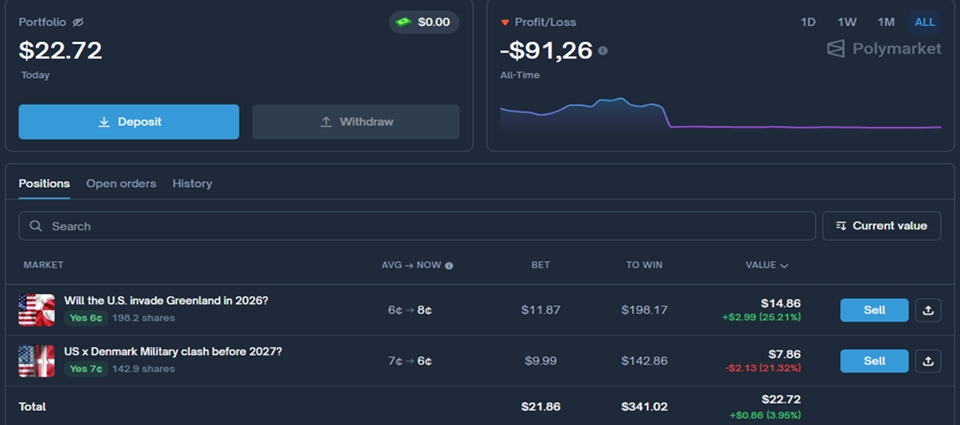

Profits, Losses, and Selling Before Settlement

Understanding how profits and losses move on Polymarket is more like trading stocks than placing a traditional sports bet. Let’s go through the brief breakdown below, so you can understand it better:

- Every Yes/No market is mathematically anchored to a $1.00 payout.

- Profit depends on the entry price, not just being correct.

For example, you can buy a $0.60 YES share and sell it at $1.00. This brings a higher profit than buying it at $0.90, even if both bets are correct.

- You can sell positions before settlement, allowing you to secure profits, minimize losses, or respond to new information, similar to an early cashout or trading odds.

How to Bet on Polymarket (Step-by-Step)

Below is a simple, bettor-friendly walkthrough explaining how to place a bet on Polymarket using crypto. You need to follow these steps:

What Can You Bet On at Polymarket?

Polymarket has multiple betting categories. While the biggest focus is on sports-related events and cryptocurrency markets, you can also bet on other major categories, including politics, technology, and trend markets.

1. Polymarket Sports Betting and Event-Based Markets

The sports-related prediction markets on Polymarket are long-term, event-based bets rather than single-match betting. Here are the most common ones that you can place your wagers on:

⚽ Football (Soccer): You can buy shares for major tournament winners, league champions, season outcomes, and organizational decisions tied to top leagues and international competitions.

🏈 NFL: When it comes to football betting, you can buy YES/NO shares about Super Bowl winners, conference champions, season outcomes, coaching changes, and major franchise-level decisions.

🏀 Basketball: This category lets you bet on the NBA season outcomes, playoff runs, Finals winners, and major league awards.

🥊 UFC/Combat Sports: If you’re a UFC or combat sports enthusiast, then you can wager on title fights, main-event outcomes, and major UFC cards tied to headline fighters.

Keep in mind that Polymarket supports many additional sports and event-driven markets beyond these examples.

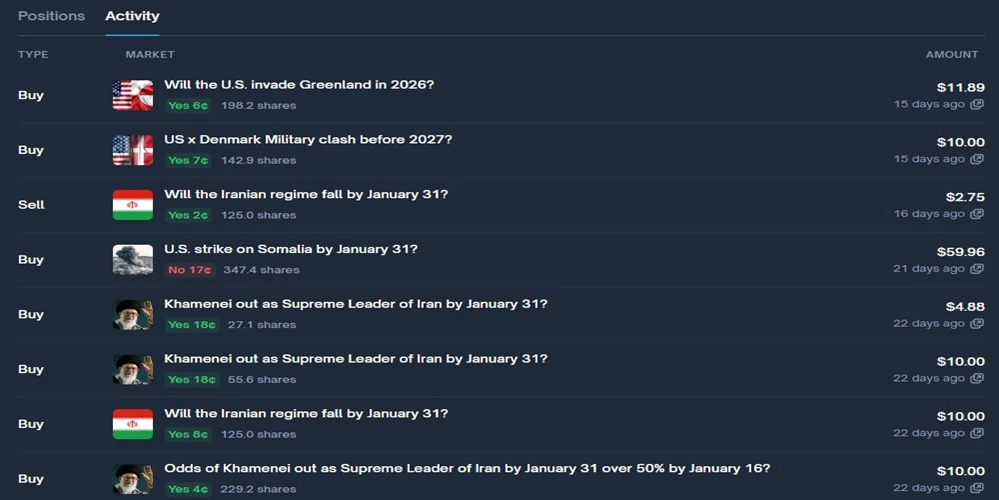

2. Crypto and Financial Markets

Crypto-related markets are among the most popular on Polymarket, including Bitcoin price targets, ETF approvals, protocol launches, and major macroeconomic or interest-rate decisions.

These markets attract active trading as investors watch the outcomes closely, allowing them to move quickly. As a result, you can speculate on high-profile events that directly impact the broader crypto and financial landscape.

3. Politics, Technology, and Trend Markets

Other high-volume prediction market categories on Polymarket include events where information flow and speculation drive rapid price movement, such as:

- Political Events: In this category, you can buy YES/NO shares about upcoming elections, leadership changes, resignations, geopolitical outcomes, and policy decisions with global impact.

- Technology Launches: You can also bet on major product releases, corporate announcements, acquisitions, and strategic decisions by large tech companies.

- AI and Emerging Tech: For those interested in AI and other tech developments, Polymarket enables wagering on AGI milestones, OpenAI announcements, AI regulation, adoption benchmarks, and industry breakthroughs.

- Crypto-Adjacent Trends: You can also buy shares about ETF approvals, protocol upgrades, forks, regulatory actions, and ecosystem-level developments.

- Cultural and Media Trends: Ultimately, you can pick a category where you can bet on award shows, celebrity events, and viral topics that attract speculative volume but carry higher risk.

Risks of Polymarket Betting

As you’re betting real money in a market-driven environment, you must be aware of the key risks involved. In the section below, we’ll explore the most common ones.

Financial Risk and Volatility

- Market prices fluctuate 24/7 as new information emerges, affecting you regardless of the coin you use.

- Users are buying and selling to themselves to create a false sense of activity to mislead other traders.

- Sometimes, you are up against trading bots, used by professional traders, that act on changes in milliseconds

Market Resolution and Data Sources

If a market is poorly defined, resolution can be delayed for weeks or result in a NO.

Polymarket relies on the UMA Optimistic Oracle to determine winners, but resolution depends on UMA token holders voting on the outcome; large bettors can influence the vote to ensure their own payout regardless of the truth.

Regulatory Uncertainty

Polymarket secured a federal license in late 2025 to operate in the U.S. via regulated brokers. Despite that, many local jurisdictions (several U.S. states such as Nevada, and countries like France, Portugal, and Italy) have issued outright bans.

Users in those regions can withdraw funds but can’t place new bets. The use of a VPN directly violates the terms, leading to a permanent ban and financial loss.

Who Is Polymarket Best For?

Polymarket is best for different types of bettors. The most suitable ones are:

✔️ Crypto-native users who are comfortable with using blockchain wallets and digital coins like the USDC.

✔️ Experienced bettors who understand probabilities and market-driven odds.

✔️ Active traders who value the ability to exit positions early, benefiting from Polymarket sports betting features, such as market-driven odds and flexible share trading.

Frequently Asked Questions

Can you bet on Polymarket?

Yes, you can bet on Polymarket by connecting a crypto wallet and using USDC to trade on the outcome of global events. However, availability depends on your local jurisdiction and regional regulatory requirements

Can you actually make money on Polymarket?

Yes, you can profit by accurately predicting event outcomes or by selling your shares at a higher price than you purchased them before the market closes. Winning shares always settle at a fixed value of $1.00.

How does Polymarket pay out winnings?

Winnings are paid out automatically via smart contracts that settle winning shares at $1.00 USDC. Once a market is resolved, funds become available for withdrawal directly to your connected crypto wallet.

What is Polymarket betting?

Polymarket betting refers to wagering on outcomes of real-world events, like sports, politics, economics, technology, etc., on a decentralized prediction market using cryptocurrency.

How is the price of a market determined?

The price of a market is determined by tracking the real-time supply and demand. Basically, as you buy or sell YES/NO shares, you drive the trading activity on the platform, which affects the price in real time.

Can I sell my bet before the event happens?

Yes, you can sell your bet before the event happens. This is because Polymarket allows you to exit positions early by just selling your YES/NO shares.

Is Polymarket betting legal?

While Polymarket betting is legal, you should keep in mind that it has faced some regulatory scrutiny in certain jurisdictions. Therefore, you need to check local laws before engaging in trading activity on the platform.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Will Wood

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com