Surging Profits Spark Euphoria Concerns

According to on-chain data from CryptoQuant, the “supply in profit” metric, which measures the percentage of BTC holders above their cost basis, has climbed to 86.8%, rebounding from a dip to 75% earlier this year. This surge aligns with Bitcoin’s price hovering around $96,000.

Historically, when this metric surpasses 90%, markets often enter a euphoric phase, followed by corrections, as seen in 2017 and 2021.

The current profitability is driven by Bitcoin’s strong performance in 2024, with a 152% price increase from January to December, pushing BTC past the $100,000 mark in December 2024. However, recent global events, including U.S. tariff policies and regulatory shifts, have introduced volatility, prompting analysts to question whether the rally can sustain its momentum.

On-Chain Signals and Market Sentiment

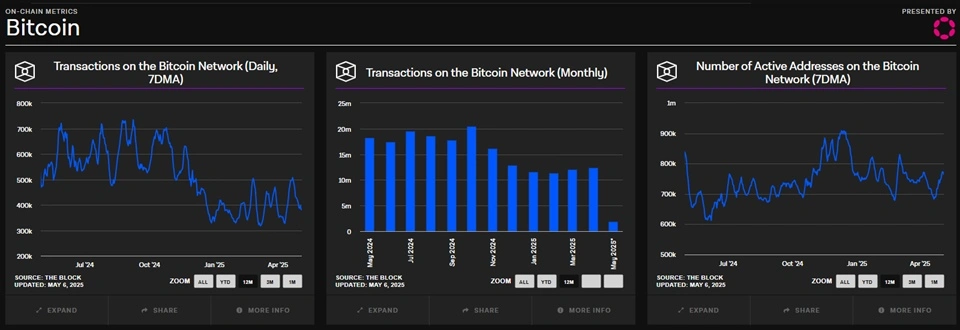

IntoTheBlock reports that daily active Bitcoin addresses have spiked to over 750,000. This uptick often precedes heightened volatility or bullish momentum, as new participants enter the market. However, Glassnode notes that 88% of the BTC supply remains in profit, with losses concentrated among buyers who entered at $95,000–$100,000.

The Short-Term Holder (STH) Profit/Loss Ratio, a key indicator, has returned to a neutral 1.0, per Glassnode. Historically, a sustained move above this threshold signals stronger momentum, while failure to break through could indicate resistance. While high profitability supports bullish trends, crossing the 90% mark could trigger profit-taking, especially among retail investors.

In past cycles, such as March 2024, when BTC hit $73,800, a 23% correction followed high profitability levels.

Institutional Demand and ETF Inflows

Spot Bitcoin exchange-traded funds (ETFs) have amassed over 1.1 million BTC, surpassing even Satoshi Nakamoto’s estimated 1.1 million BTC holdings. BlackRock’s iShares Bitcoin Trust alone holds 539,020 BTC, valued at $57.69 billion, while Fidelity’s FBTC manages 199,967 BTC. These ETFs, which crossed $100 billion in assets under management in December 2024, have become the preferred vehicle for institutional exposure.

Recent announcements, such as the $3.6 billion 21 Capital Bitcoin investment venture by Cantor Fitzgerald, SoftBank, Bitfinex, and Tether, signal growing institutional appetite. Tether’s strategy to allocate 15% of its net profits to BTC purchases has bolstered its holdings to 83,758 BTC. Meanwhile, corporate treasuries like MicroStrategy, with 528,185 BTC, and Semler Scientific, with 3,634 BTC, reflect a trend of companies using Bitcoin as a hedge against inflation.

Global Events and Regulatory Shifts

The United States, under President Trump’s 2025 crypto crusade, has amassed a formidable 205,515 BTC in its Strategic Bitcoin Reserve, worth $19 billion. With the BITCOIN Act pushing for 200,000 BTC annual purchases, Washington is poised to choke global Bitcoin supply, flexing its economic muscle.

But across the Pacific, China holds a wildcard: 194,000 BTC, confiscated from shadowy operations. Should Beijing unleash this stockpile, it could crash markets and destabilize the crypto sphere.

U.S. tariff policies, particularly on imports, are raising red flags about inflation, prompting investors to eye Bitcoin as a deflationary safe haven. However, the cryptocurrency’s allure is tempered by regulatory hurdles. El Salvador, for instance, is scaling back its bold Bitcoin experiment to secure a $1.4 billion IMF loan.

Elsewhere, Russia’s legalization of Bitcoin mining and Bhutan’s hydropower-driven mining initiatives signal growing global acceptance.

Is a Bitcoin Correction Imminent?

Analysts are divided on Bitcoin’s near-term path. Bloomberg’s crypto strategist predicts that sustained ETF inflows and institutional demand could push BTC past $100,000 again, especially if U.S. regulations ease under SEC chair nominee Paul Atkins.

However, CoinTelegraph warns that a supply-in-profit metric nearing 90% could signal a short-term top, as seen in October 2024, when a 94% profitability rate preceded an 8.7% drop.

Technical indicators offer mixed signals. A potential golden cross between the 21-day EMA and 50-day SMA, last seen in 2016, could propel BTC higher, per crypto commentator Moustache. Yet, resistance at $96,000 and profit-taking by short-term holders remain hurdles.

Binance’s cold wallet, holding 633,000 BTC, and Bitfinex’s 109,586 BTC reflect concentrated exchange holdings, which could amplify price swings if moved.

Bitcoin’s 2025 Gamble: Hype, Hope, and Hidden Risks

Bitcoin’s boasting an 85% profitability rate, sure, but don’t pop the champagne yet. Tariff-driven market jitters and regulatory flip-flops prove this crypto darling’s not invincible. Big players and ETF inflows are propping up the optimism, but let’s be real, greedy profit-taking could tank the party any minute.

If you’re playing this game, keep a hawk’s eye on on-chain metrics, ETF flows, and whatever new rules the world’s governments cook up. 2025 could see Bitcoin break out or crash hard.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Will Wood

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com