Digital Gold Era Takes Center Stage

Gold has long held its place as the go-to safe-haven asset, but in 2025, its 23% gain has been eclipsed by Bitcoin’s surging momentum. While gold typically shines during economic turbulence, Bitcoin’s rally this year is being driven by a different mix—risk-on appetite and strong institutional backing.

According to SoSoValue, cumulative inflows into spot Bitcoin ETFs hit $40 billion in May, highlighting Bitcoin’s evolution from a speculative bet to a mainstream investment choice.

Early Skeptics Turning to New Believers

In Bitcoin’s early days, when it traded for just a few cents in 2010 or hovered around $1,000 in 2013, it was widely dismissed as a fad or a playground for illicit finance. Fast forward to 2025, and many of those early critics are rethinking their stance.

Prominent investors like Bill Miller IV (speaking on CNBC) have boldly claimed Bitcoin is on track to challenge gold’s $20 trillion market cap. Bitcoin is no longer just a tech experiment but a maturing asset class.

For those who watched from the sidelines, the sense of missed opportunity is hard to ignore. Anyone who bought Bitcoin at $100 in 2013 is now sitting on gains of over 1,000x. Still, the broader crypto landscape suggests there’s room to participate.

Bitcoin’s rise has laid the groundwork for other digital assets to flourish, with altcoins increasingly gaining attention as the market matures.

Altcoins Riding Bitcoin’s Wave

As Bitcoin soars, other cryptocurrencies are catching investors’ eyes.

- Ethereum (ETH), for instance, posted its best week since 2021, driven by its role in decentralized finance and smart contracts.

- Solana (SOL) has also gained momentum, with a 25% price increase in May 2025, fueled by its high-speed blockchain and growing ecosystem of decentralized applications, according to CoinMarketCap data.

- Meanwhile, meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) continue to captivate retail investors. Dogecoin’s market cap grew to $35 billion in 2025, buoyed by social media buzz and endorsements from figures like Elon Musk.

These altcoins, while riskier, reflect the broader crypto market’s dynamism. Unlike Bitcoin, which benefits from first-mover advantage and institutional trust, meme coins thrive on community engagement and viral momentum.

Investors are drawn to these assets for their potential high returns, but the market’s unpredictability remains a key consideration.

Macro Drivers and Market Outlook

Bitedge’s analysts point to expanding crypto derivatives markets and corporate adoption as catalysts for Bitcoin’s outperformance. Regulatory clarity, expected in late 2025, could further boost institutional inflows. Meanwhile, gold’s strength, driven by central bank buying and inflationary fears, hasn’t deterred Bitcoin’s rise.

Goldman Sachs predicts gold could hit $3,700 per ounce by year-end, yet Bitcoin’s 12% year-to-date gain suggests it’s capturing a broader investor base.

Global uncertainties, including U.S. debt concerns and easing U.S.-China trade tensions, have created a dual narrative: gold as the traditional haven and Bitcoin as a hedge against systemic risks.

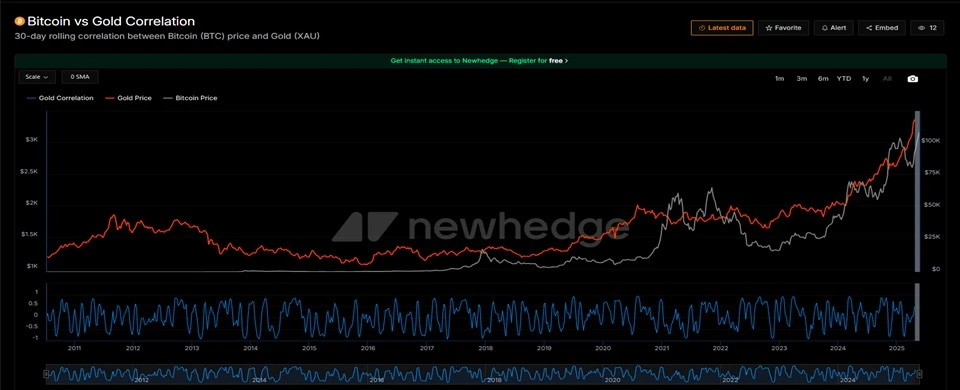

Source: newhedge.io/bitcoin/gold-correlation

What’s Next for Bitcoin and Gold?

Our analysts now project that Bitcoin could climb to $220,000 before the end of 2025, citing its historical four-year cycle and gold-aligned “power curve” models. Still, not everyone is ready to crown Bitcoin as the new king. MEXC’s Tracy Jin points out that gold’s enduring stability continues to attract conservative investors.

Bitcoin’s volatility, highlighted by a 10% swing just in April, remains a sticking point. But with institutional interest deepening and broader adoption underway, many see Bitcoin moving steadily toward long-term stability.

For now, Bitcoin overtaking gold per kilo marks a symbolic milestone more than anything else.

As the crypto market continues to mature, investors are treading carefully, weighing Bitcoin’s growing promise against the rising potential of altcoins and the time-tested stability of gold.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Maryam Jinadu

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com