Coinbase Jumps into Regulated Event Trading

The past two years have seen a dramatic surge in demand for event-based markets. Retail investors increasingly want tools that allow them to trade outcomes tied to elections, inflation readings, sports, product launches, or economic indicators.

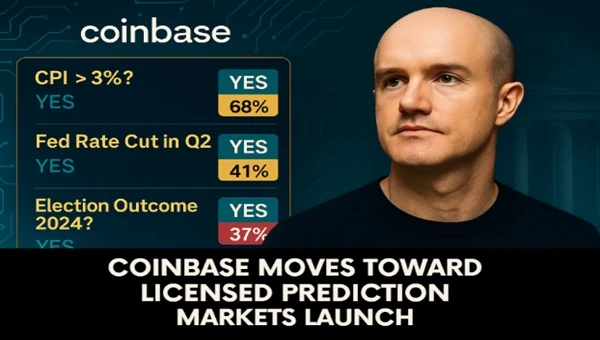

Coinbase appears ready to position itself at the center of that movement, setting the stage for a regulated alternative to offshore platforms that have dominated the space.

The platform is expected to integrate with Kalshi, the only federally regulated prediction market operator with CFTC approval for a wide range of event contracts. Kalshi has spent much of 2024 fighting regulatory battles to expand its offerings, winning several decisions that opened doors for institutional-grade forecasting markets.

Coinbase’s involvement gives Kalshi access to millions of retail users already familiar with structured trading tools.

Coinbase has signaled interest in prediction markets since early 2024 through technical repositories, internal portal designs, and ongoing discussions about building an integrated event-trading layer on top of Base, its layer-2 network.

Prediction Markets: A Natural Fit for the Trading Ecosystem

The move aligns with the company’s broader regulatory posture, where it continues to pursue licenses that bring novel financial products into U.S. compliance rather than route them offshore.

At the same time, Coinbase has been developing a tokenized stock and assets platform, allowing fractional exposure to equities and other traditional instruments. Prediction markets fit naturally into that long-term strategy. Retail traders could eventually move between spot crypto, tokenized equities, event forecasting, and structured derivatives within a single interface.

Prediction markets surged into mainstream attention during several quantifiable global events. In the 2020 U.S. election cycle, platforms like PredictIt and Polymarket reported a combined over $1 billion in cumulative trading volume, driven by record retail interest in outcome-based contracts.

Activity spiked again in 2021 during the inflation shock, when traders used event markets tied to CPI readings to anticipate policy moves as U.S. inflation climbed from 1.4% in January to 7% by December.

The 2021–2022 crypto bull run added another wave: Polymarket posted over $135 million in annual volume, and offshore prediction venues saw user growth rates exceeding 200% year-on-year as traders looked for tools to quantify expectations around Bitcoin halving timelines, ETF approvals, and regulatory shifts.

By 2024, global prediction market volume, including regulated and unregulated venues, crossed an estimated $2.5 billion, supported by wider adoption in Europe and Asia. In the U.S., Kalshi became the only federally regulated operator. It reported steady growth in weekly contracts traded, especially in macro-linked markets such as inflation ranges, jobs reports, and rate-decision outcomes.

Retail users have consistently shown interest in these instruments because they mirror tools used by institutional desks: tradable probabilities, measurable outcomes, and defined settlement rules.

The difference is accessibility.

Retail traders prefer simpler interfaces, lower entry thresholds, and transparent settlement frameworks, areas where Coinbase historically excels.

A Regulated Alternative in a Shifting Landscape

Coinbase’s effort stands in contrast to several global competitors:

- Binance previously tested event-based products but faced restrictions in multiple jurisdictions.

- Polymarket, popular for its simple interfaces and large user flows, remains unregulated in the U.S.

- Deribit and Bybit have explored futures tied to unique indicators but avoid direct event contracts due to regulatory risk.

Coinbase attempts something different: a fully regulated, U.S.-compliant platform with institutional guardrails. If executed well, it may become the first large American exchange to merge blockchain infrastructure with government-approved event trading.

Even with Kalshi’s federal approvals, prediction markets operate in a tight regulatory environment. Legal challenges around political contracts, economic indicators, and high-impact societal events remain unresolved. Coinbase’s approach suggests the company intends to stay strictly within existing futures and event-contract rules, avoiding the grey areas that previously caused enforcement actions elsewhere in the industry.

If regulators provide broader clarity in the coming year, Coinbase’s early infrastructure may allow it to scale faster than its peers.

What Comes Next?

Coinbase has not announced a launch date, but progress across technical repositories and industry reporting points to an active build phase. Retail traders are already anticipating features integrated with Base, possibly linked to incentives similar to those used in earlier ecosystem expansions.

Coinbase is positioning itself at the intersection of tokenization, regulatory evolution, and the growing global appetite for outcome-based financial forecasting.

The move could reshape how U.S. retail participants interact with real-world events and possibly set a precedent for other exchanges aiming to formalize prediction markets within traditional finance.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Josip Putarek

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com