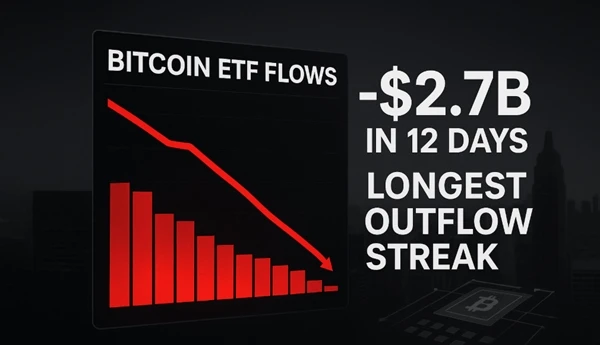

The Longest Outflow Streak

The withdrawals began quietly on November 18 and accelerated sharply after Thanksgiving. Daily redemptions ranged from $78 million to a peak of $429 million on December 5, according to data compiled by Bloomberg and confirmed by BlackRock’s own filings. In total, investors have yanked 28,400 BTC from the trust in less than three weeks.

For context, IBIT enjoyed near-unbroken inflows for most of 2024, pulling in a record $21 billion in its first ten months and briefly overtaking BlackRock’s own iShares Gold Trust as the fastest-growing ETF in history. The reversal has been abrupt and unmistakable.

Macro Headwinds and Year-End Trimming Drive Investor Exodus

Several forces appear to be colliding at once.

Bitcoin itself has fallen roughly 18% from its mid-November all-time high above $109,000 and now trades in the low $92,000s. Macro headwinds have intensified: the Federal Reserve has signaled a slower pace of rate cuts in 2025, the U.S. dollar index has climbed to a two-year peak, and ten-year Treasury yields have surged past 4.6%.

Risk assets, including crypto, have felt the squeeze.

Many of the same hedge funds, family offices, and registered investment advisors that piled into IBIT during the post-election rally in early November have spent the past month trimming exposure ahead of year-end.

Tax-loss harvesting in other parts of client portfolios may have added further downward pressure.

Competitor Flows and Market Resilience

Competitors tell a mixed story. Fidelity’s Wise Origin Bitcoin Fund (FBTC) recorded modest inflows during the same period, while ARK 21Shares Bitcoin ETF and Bitwise’s offering saw smaller outflows than IBIT.

Grayscale Bitcoin Trust (GBTC), long the laggard because of its higher fee, actually benefited from inflows as some investors rotated toward the discounted trust. BlackRock’s dominance made it the easiest and most liquid exit door when sentiment turned.

The crypto market has experienced similar institutional drawdowns before. In May–July 2022, Three Arrows Capital, Celsius, Voyager, and others collapsed in rapid succession, triggering $4 billion in outflows from GBTC alone.

The current episode differs in one critical way: the Bitcoin price has not yet entered a full bear market, and the ETFs themselves have functioned exactly as designed, processing creations and redemptions smoothly without any forced liquidation or gate imposition.

Still, the speed of the reversal has caught some market participants off guard. One portfolio manager at a $12 billion multi-strategy fund, while speaking to Bloomberg last week, said his desk had reduced Bitcoin exposure from 6% to under 2% “almost entirely through IBIT because the liquidity is unmatched.”

Authorized participants such as Jane Street and Goldman Sachs have handled the redemption baskets without disruption.

BlackRock executives have remained publicly calm. During a December 4 investor call, global head of ETFs Rachel Aguirre stressed that “short-term flows are noisy” and pointed out that the firm’s broader digital-assets product suite, including its Ethereum ETF and tokenized fund pilot, continues to attract interest.

Market Outlook: Volatility and Mixed Technical Signals Cloud IBIT’s Future

Whether the bleeding stops soon remains an open question. Options markets are pricing in elevated volatility through the January expiration, and leveraged long positions in Bitcoin futures have dropped to their lowest level since October.

On-chain data show long-term holders continuing to accumulate, but exchange balances have ticked higher, a classic sign of distribution.

For now, the giant that powered Bitcoin’s march into mainstream portfolios has become the clearest barometer of cooling enthusiasm.

Twelve straight days of outflows do not undo eleven months of inflows, but they do remind investors that even the most successful crypto product ever launched is not immune to the same cycles that have defined the asset class since 2009.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Josip Putarek

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com