XRP Activity

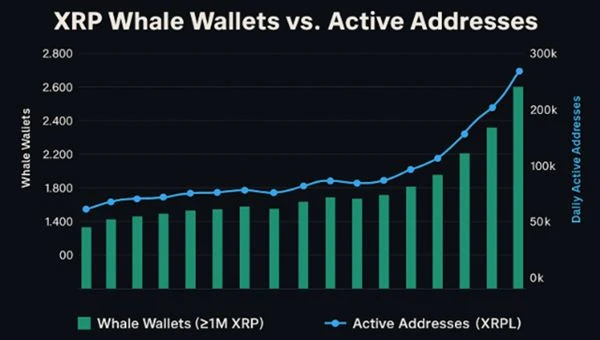

Data from Santiment shows that daily active addresses on XRP Ledger surged from an average of 40,000 to nearly 295,000; an increase that signals broader engagement beyond retail speculation. The boost in on-chain interactions comes as more enterprise-grade tools and applications are deployed on the network, including tokenized securities and cross-border payment pilots.

The XRP Ledger’s core appeal remains its low transaction costs and high throughput. Transactions settle in 3 to 5 seconds and cost less than a cent, a key factor for institutions exploring alternatives to Ethereum’s congested Layer 1.

Ripple’s existing relationships with banks and financial institutions, including Santander and Standard Chartered, continue to position XRP as a contender in payment infrastructure.

Still, volatility remains a factor. XRP experienced similar momentum in Q1 2025, with a 36% increase in payment transactions and a 142% rise in active addresses. That surge tapered off by early June, with on-chain activity falling 45%. The current numbers may reflect temporary spikes unless sustained by broader adoption.

Whale Wallet Count Reaches All-Time High

More than 2,708 wallets now hold at least 1 million XRP, according to on-chain analytics. This represents a new high in the asset’s 12-year history. These holdings, currently worth over $525,000 per wallet, suggest accumulation from institutional players and high-net-worth individuals positioning ahead of potential regulatory or market shifts.

Some of the most notable additions this year include VivoPower, which allocated $121 million worth of XRP as a strategic reserve in May 2025. Webus International is reportedly preparing a $300 million XRP buy-in, citing long-term exposure to Ripple’s financial products.

These moves mark a shift from retail-led speculation to larger, coordinated positioning.

However, recent on-chain flows reveal some risk. A $498 million transfer to an unidentified wallet earlier this month sparked discussion about liquidity risks, and a separate $57.7 million sale to Coinbase hints at partial exits.

This aligns with behavior seen across the market; Solana whales increased holdings by 15% in Q2, while Dogecoin saw over 1.5 billion tokens absorbed in April, but XRP’s positioning appears more strategic and less sentiment-driven.

Price Consolidation Ahead of Potential Breakout

XRP is currently trading around $2.24 with a market cap of $132.37 billion, marking a modest 3.24% gain over the last 24 hours.

Technical analysis suggests price action is approaching a breakout zone, with a falling wedge pattern pointing toward a potential move to $3.40 if $2.25 is breached. A drop below $2.20 could instead trigger a slide to the $2.08 support level.

Meanwhile, XRP’s derivatives volume has increased by more than 300% in two weeks, indicating rising leverage. Traders are divided: some view this as confirmation of a bullish setup, while others caution that the sharp rise in open interest could lead to rapid reversals if long positions get liquidated.

The recently launched XRP ETF on Euronext introduced new volatility. Despite a 20% drop on debut, it brings formalized institutional exposure to XRP markets in Europe, possibly setting a precedent for U.S. entrants if regulatory clarity improves.

Ripple’s Roadmap and Regulatory Risk

Ripple executives are moving to improve the ledger’s competitiveness. CTO David Schwartz is advocating for dynamic fee models to better adapt to network demand, while CEO Brad Garlinghouse made headlines during the 2025 XRPL Apex Summit by projecting that XRP Ledger could capture 14% of global SWIFT liquidity within five years.

Such projections depend heavily on regulatory developments. While Ripple’s case with the SEC appears to be nearing resolution, uncertainty continues to limit institutional participation in U.S. markets. The absence of a clear framework has kept several asset managers and financial firms in a wait-and-see mode.

In contrast, Europe has moved more quickly. The Euronext listing, despite its shaky start, represents a concrete step toward legitimizing XRP as an investable product. Further filings in Asia may follow, depending on regulatory coordination.

Outlook

XRP Ledger’s surge in user activity and institutional wallets presents one of the clearest signals of renewed interest in Ripple’s ecosystem in years. The pace and scale of engagement—both from whales and on-chain activity—mark a shift from speculative trading to infrastructure-oriented adoption.

Still, XRP’s price action remains tied to macro risk, regulatory clarity, and follow-through from developers.

Whether these trends can hold or will revert like in early 2025 remains an open question.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Maryam Jinadu

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com