Best Crypto Exchanges in 2026: All platforms at a glance!

Below is a quick overview of our top cryptocurrency exchnages in the world at a glance.

Our experts thoroughly tested these over a three-month period to assess their usability and trustworthiness.

Each exchange has its strengths, so we’ve highlighted why it stands out:

| Provider | Category |

| Coinbase | Most reliable crypto exchange platform for beginners |

| Binance | Best for more experienced beginners |

| Crypto.com | Best Crypto exchange for staking |

| Kraken | Lowest Fees |

| Gemini | Best Security |

| Crypto.com | Best Mobile App |

| Coinbase | Best for Bitcoin |

Now that you’ve seen the quick highlights of the best cryptocurrency exchnage platforms, let’s go into more details. We’ll cover their key features, fees, security, and what type of user they best serve.

Choose from the Top rated Cryptocurrency Exchanges

1. Coinbase – Most reliable Crypto Exchange for Beginners

Coinbase is often the first name that comes to mind when discussing beginner-friendly exchanges. Founded in 2012 and based in the United States, the service has grown into a leading cryptocurrency trading platform with over 100 million users worldwide.

On Coinbase, you can quickly buy crypto using a connected bank account, debit card, PayPal, or other methods.

It supports all major cryptocurrencies, as well as a substantial selection of altcoins, numbering over 200. For many people, Coinbase provides the first crypto wallet they ever use, as it stores your purchased coins for you by default.

Coinbase’s user interface is highly intuitive. If you’ve ever used an online banking or stock investing app, Coinbase will feel familiar. You can view your portfolio balance, price charts, and a large button to “Buy/Sell” cryptocurrency.

There’s even a Coinbase Learn section with short educational modules, and a feature called Coinbase Earn where you can earn small amounts of new cryptocurrencies by watching videos/quizzes.

The Coinbase mobile app is highly rated for its smooth user experience, which is excellent if you prefer managing your crypto on smartphones or tablets.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.4% / 0.6% (Advanced Trade) – up to ~1.5% on Simple | Tiered by volume; higher flat fees on simple buys. |

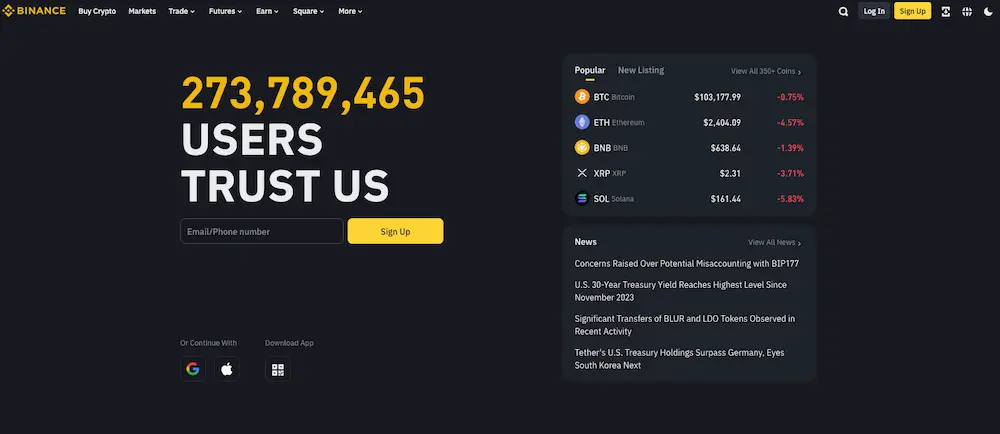

2. Binance – Best for More Experienced Beginners

Launched in 2017, Binance has grown rapidly, and as of 2025, it handles tens of billions of dollars in trades per day, far more than most of its competitors. The exchange offers a truly global platform, available in over 180 countries, although it is notably not available in the U.S.

Binance’s calling card is its low fees and extensive features. It lists over 350 cryptocurrencies and 1,300 trading pairs, covering everything from major coins to minor altcoins.

The flip side of all these choices is that Binance’s interface can feel overwhelming for beginners; however, the platform has catered more to newcomers over time, introducing simpler modes in its app.

On the main Binance website, you’ll find different views: a basic convert tool, a classic trading interface, and an advanced trading interface with professional charts.

For new users, the Binance mobile app may be the easiest way to get started, as it offers a toggle between “Lite” and “Pro” modes.

Binance Lite offers a simplified interface that allows you to buy or sell crypto with just a few taps, view your portfolio, and stay focused on the essentials.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.1% / 0.1% (standard) | Tiered by volume; 25% discount with BNB token. |

3. Crypto.com – Best Crypto Exchange for Staking

Crypto.com is based in Singapore and has aggressively expanded globally, securing licenses in many countries. For beginners, Crypto.com is appealing because it provides a one-stop shop: you can buy and sell crypto, earn interest, pay with crypto using their Visa card, trade NFTs, and more, all in one place.

The exchange heavily promotes its native token, CRO. If you choose to buy and stake CRO, you unlock various benefits: trading fee discounts, higher interest rates in Earn, and better cashback and perks on the Crypto.com Visa Card. Last but not least, is it one of the best crypto exchanges with user-friendly interface.

For example, staking 5,000 CRO might reduce your trading fees slightly and increase your card cashback to 2%. Staking larger amounts yields even more rewards, such as Spotify or Netflix rebates or airport lounge access on higher-tier cards.

While this is attractive, as a beginner, you don’t need to worry about CRO right away. Focus on learning about crypto, and later, you can evaluate whether staking CRO for benefits makes sense for you.

When you sign in from a new device, Crypto.com requires email confirmation. They provide options like anti-phishing codes for emails, as well as require setting up two-factor authentication (2FA) for certain actions.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.25% / 0.5% (no CRO stake) | Tiered by volume; 20%+ fee reduction with CRO stake. |

4. Kraken – Lowest Fees

Kraken is one of the longest-running crypto exchanges, known for its strong security and low fees. It might not have the flashy marketing of some competitors, but ask seasoned crypto users, and many will recommend Kraken for its trustworthiness. Kraken supports a wide range of cryptocurrencies, with over 200 coins and more than 700 trading pairs as of 2025, including all the major cryptocurrencies and many altcoins.

For beginners, Kraken offers a good balance: it’s simpler than Binance but more feature-rich than Coinbase’s basic mode. It’s often recommended to those who want a serious platform to invest in crypto long-term.

Kraken uses a tiered maker-taker fee schedule on its Kraken Pro trading platform. For low-volume traders with a lifetime trading volume of under $50,000, the fees are 0.16% for makers and 0.26% for takers. This is quite competitive and lower than Coinbase’s 0.4–0.6% on their advanced trade.

In fact, Kraken reduced some fees recently but also introduced a small spread for the very lowest tier: currently, the first $10k of trading in 30 days might incur about 0.20%/0.40%, and it drops to 0.16%/0.26% when you trade over $50k monthly.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.2% / 0.4% (entry tier) | Tiered by volume; lower fees with higher volume. |

5. Gemini -Best Security

Gemini is a U.S.-based cryptocurrency exchange that brands itself around trust, security, and regulatory compliance. It was founded in 2014 by Cameron and Tyler Winklevoss, and it operates under a New York trust license, which imposes strict requirements. For beginners who are particularly cautious and looking for a secure, regulated platform to start with, Gemini is a compelling option.

While the exchange may not list every coin, it offers a curated selection of major cryptocurrencies, including virtually all the top market cap assets. It’s often recommended for newcomers in the U.S., and it’s available in many countries worldwide as well.

The onboarding process with Gemini is user-friendly: you sign up, verify your identity (since it’s a regulated exchange, Know Your Customer (KYC) is required), and then you can connect your bank account or card to fund your account. Gemini supports ACH bank transfers in the U.S., which are quick and usually free. They also support wire transfers, and you can instantly buy using a debit card.

When it comes to fees, Gemini has two structures: if you use the default interface, Gemini charges a convenience fee (~0.5% built into the price) plus a flat transaction fee on each trade.

ActiveTrader uses a maker-taker model with much lower fees. It starts at 0.20% maker / 0.40% taker for volumes under $10,000 per month, then 0.15%/0.30% for volumes under $50,000, and continues to decrease, reaching 0.1%/0.25% for volumes over $50,000.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.2% / 0.4% (ActiveTrader) – 1.49% basic | Tiered by volume, the basic interface uses a flat fee. |

6. KuCoin – Best for Altcoins

Launched in 2017, KuCoin is a globally popular cryptocurrency exchange, often noted for having one of the largest selections of coins. It supports over 700 cryptocurrencies and 1,200 crypto trading pairs, making it a go-to platform for trading a vast array of altcoins. KuCoin is accessible worldwide and has a reputation for being highly community-driven—hence its nickname, “the People’s Exchange.”

For beginners outside the U.S., it’s a great place to explore smaller cap projects once you’ve gotten your feet wet with the majors. KuCoin’s interface is modern and relatively intuitive, although it is a bit more complex than beginner-focused exchanges like Coinbase. Both the app and the website offer basic and advanced modes. Even in basic mode, you’ll see a lot of information, but you can simply use the search bar to find the coin you want and hit buy/sell. KuCoin also offers features like a trading bot and margin trading, which you can ignore as a newcomer.

The standard fee is *0.1% for both makers and takers, similar to Binance. If you pay fees using KuCoin’s native KCS token, you get a 20% discount, bringing fees down to 0.08%. They also have tiered fees; if you trade large volumes or hold a significant amount of KCS, the fees decrease further.

For most beginners, 0.1% is effectively what you’ll pay, which is excellent, considering it’s only $0.10 on a $100 trade. There are no fees for depositing crypto. For fiat, KuCoin historically did not support direct bank deposits, but it partners with third-party services for credit card purchases.

| Trading Fees (Maker/ Taker) | Fee Structure |

| 0.1% / 0.1% | Tiered by volume: 20% off when paying with KC. |

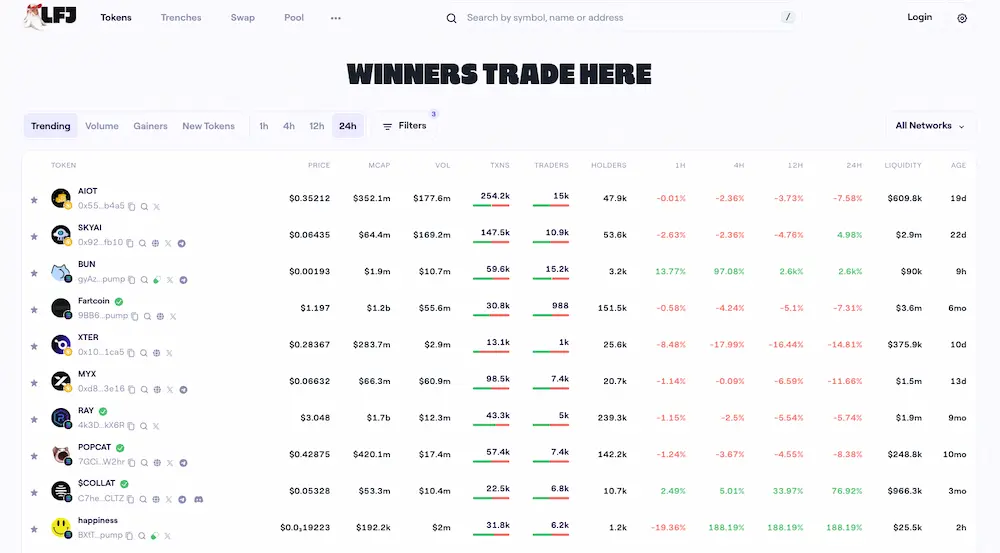

7. LFJ – Best for Highly Experienced Traders

Unlike the other exchanges in this list, LFJ is not a centralized exchange – it’s a decentralized exchange interface where you trade directly from your crypto wallet. This means there is no account signup or custody by the platform. LFJ connects to liquidity on various blockchains to get you the best prices on token swaps. It supports over 200 tokens and around 286 trading pairs on its Avalanche deployment.

We include LFJ as an example of a DEX that even beginners may have heard of. For someone just starting, using LFJ will be a different experience than using a CEX like Coinbase. You would need a cryptocurrency wallet (such as MetaMask) and some cryptocurrency to pay transaction fees on the network. The LFJ interface is quite user-friendly for a DEX, but it is best suited for experienced traders.

To get started, connect your wallet, select the token you want to swap, and it will display the best rate aggregated from various liquidity pools. There is no trading fee paid to LFJ itself; instead, you pay the standard DEX liquidity provider fee of approximately 0.3% per swap on Trader Joe, as well as network gas fees.

| Trading Fees (Maker/ Taker) | Fee Structure |

| ~0.3% swap fee + gas | Liquidity provider fee on DEX swaps; network gas fees apply. |

Top 10 trusted Crypto Exchanges

Security and Reputation

Cryptocurrency exchanges are essentially banks for your digital assets, so security and reputation are of paramount importance. Here are key security factors and how our top exchanges stack up:

1. Fund Storage (Cold vs. Hot Wallets):

Reputable exchanges typically keep the bulk of user funds in cold storage, thereby minimizing the risk of hacks. For example, Coinbase reports that 98% of its customer crypto is held offline, with only 2% in hot wallets, which are insured against theft.

- Kraken similarly keeps around 95% of its assets in cold storage and has conducted proof-of-reserves audits to demonstrate full reserves.

- Gemini also stores the majority of coins in cold storage and has comprehensive asset insurance.

When evaluating an exchange, check if they disclose their cold storage percentages and insurance details.

2. Security:

All top exchanges offer two-factor authentication (2FA); ensure you enable it, ideally via an app like Google Authenticator or Authy, rather than SMS. Many also support hardware keys for an added layer of security.

- In summary, all the exchanges recommended in this guide are secure and reputable in the crypto space.

- They employ state-of-the-art security and have withstood the test of time (in crypto, that’s a significant achievement). Still, it’s wise to remain vigilant.

3. Insurance and KYC:

Although crypto may not have government deposit insurance like banks, top exchanges often carry private insurance and emergency funds.

- They understand that a single security failure could potentially destroy their business, so they take it extremely seriously.

- They also ensure that you complete your Know Your Customer (KYC) process, allowing them to verify your identity and maintain the security of their platform.

What Is a Crypto Exchange?

A crypto exchange is a digital platform where you can trade one currency for another. It connects people who want to buy cryptocurrencies with those who want to sell them. You can use regular money, such as euros or dollars, to obtain coins like Bitcoin or swap between different cryptocurrency tokens directly.

You’ll find two kinds. The first is a centralized exchange (CEX). This one’s run by a company, handles your coins, and walks you through every step. It’s smooth, well-regulated, and won’t leave you feeling lost. Sites like Kraken and Gemini fall into this camp.

The other is a decentralized exchange (DEX). No intermediary here. You connect your wallet, trade directly from it, and there’s no one to call if you make a mistake. It gives you more freedom, but also more room to make expensive mistakes.

For newcomers, CEXs are the safer bet. They’re easier to learn, offer better support, and help you start trading with less risk.

What is Crypto Trading & how does it work?

At its core, crypto trading means buying and selling digital assets. Just like stocks, you can place orders, wait for prices to shift, and either cash out or double down. Most beginners start by converting fiat money, such as euros, into cryptocurrency, then trading between different coins on the platform.

How Trading Works

A basic trade begins with a market order, where you buy or sell at the prevailing market rate. It’s instant and easy. Want more control? Use a limit order. That lets you set your price and wait. If the market hits it, your trade goes through. If not, it just sits there. Some exchanges also offer stop orders, but market and limit are the two you’ll use most.

Understanding Trading Pairs

Every trade occurs between two assets, referred to as a trading pair. For example, BTC/ETH indicates that you are trading Bitcoin for Ethereum. If you buy BTC/ETH, you’re spending ETH to get BTC. It’s a bit like swapping apples for oranges — every pair has a base and a quote.

Exchanges list dozens, sometimes hundreds, of pairs. Once you know how to read them, navigating the platform becomes second nature.

How to Choose the Right Crypto Exchange as a Beginner

Entering the cryptocurrency market can be overwhelming, especially when you’re faced with dozens of exchange options. As a beginner, your choice of exchange will significantly impact your investing experience. Here’s what you need to consider to make the right decision.

1. Security: Protecting Your Digital Assets

Security should be your top priority when choosing a cryptocurrency exchange. Unlike traditional banks, crypto exchanges aren’t backed by government insurance in most countries, meaning your protection depends entirely on the platform’s security measures.

Essential Security Features to Look for:

- Two-Factor Authentication (2FA): This adds an extra layer of security beyond your password. When enabled, you’ll need both your password and a temporary code to access your account. Look for exchanges that offer authentication app options, such as Google Authenticator or Authy, rather than SMS-based 2FA, which can be vulnerable to SIM swapping attacks.

- Cold Storage: Reputable exchanges store the majority of user funds in “cold storage,” which refers to offline wallets that are not connected to the internet. This approach drastically reduces the risk of hacking, as only a small portion of funds remains in “hot wallets” for immediate transactions. Exchanges should be transparent about what percentage of funds they keep in cold storage.

- Insurance Policies: Some leading exchanges maintain insurance coverage for digital assets held on their platforms. For example, Coinbase insures custodial accounts against security breaches of their systems.

- Withdrawal Security Features: Look for exchanges that require email confirmations, implement withdrawal address whitelisting, and impose time locks or additional verification for large withdrawals.

- Regulatory Compliance: Exchanges that comply with local regulations typically implement stronger security protocols to maintain their licenses. Compliance often includes regular security audits and maintaining adequate reserve funds.

Security Red Flags to Avoid:

- History of significant security breaches without transparent responses

- Lack of information about security practices on their website

- No option for 2FA or advanced security settings

- Unclear information about how and where user funds are stored

Remember that even with the best exchange security, your account is only as secure as your personal security practices. Always use a unique, strong password and enable all available security features as soon as possible after registration.

2. User Interface

As a beginner, a confusing or overly complex interface can lead to costly mistakes.

User experience should be a significant factor in your decision, especially if you’re new to trading.

User Interface Considerations:

- Intuitive Navigation:

The platform should facilitate easy access to essential functions, including buying, selling, depositing, and withdrawing. Clear menus and logical layouts reduce the risk of errors.

- Mobile App Quality:

Most people manage their crypto investments on the go. Test the exchange’s mobile app before committing significant funds. Check app store ratings and look specifically for comments about reliability and ease of use.

- Beginner-Friendly Features:

Look for exchanges that offer simplified trading interfaces specifically designed for newcomers. For example, Coinbase offers a straightforward “Buy/Sell” option separate from their more advanced Coinbase Pro trading interface.

- Visual Clarity:

Price charts, order books, and portfolio trackers should be visually straightforward to understand. Color-coding for price movements and intuitive icons help beginners quickly process information.

- Guided Processes:

The best exchanges for beginners offer step-by-step guidance for key processes, such as completing your first purchase or setting up security features.

Many exchanges offer both basic and advanced interfaces. As a beginner, start with the simplified version and gradually explore more complex features as your knowledge and skills grow.

Platforms like Coinbase, Kraken, and Crypto.com are renowned for their user-friendly interfaces, which cater to newcomers while also offering advanced options for those who are ready to advance.

3. Fees: Understanding the Cost Structure

Exchange fees can significantly impact your investment returns, especially if you plan to trade frequently.

Understanding the fee structure helps you avoid unexpected costs and make more profitable decisions. These are the common fee types:

- Trading Fees: These fees apply when you buy or sell cryptocurrencies and are usually calculated as a percentage of your transaction value. Most exchanges use a maker-taker model:

- Maker Fees: Applied when you add liquidity to the market. That means placing limit orders that don’t execute immediately.

- Taker Fees: Applied when you remove liquidity from the market.

Typically, maker fees are lower to encourage users to add liquidity. Average trading fees range from 0.1% to 0.5% per transaction

- Deposit Fees: These are charges for adding funds to your exchange account. These vary by deposit method:

- Bank Transfers: Often free or low-cost

- Credit and Debit Cards: Typically higher, ranging from 2% to 5%

- PayPal and Digital Payment Processors: Usually 2% to 3.5%

- Withdrawal Fees: Charges for moving cryptocurrency off the exchange to your wallet:

- Fixed fees based on the cryptocurrency (e.g., 0.0005 BTC or 0.01 ETH)

- These fees often reflect blockchain network fees, but may include additional exchange charges

- Conversion Fees: Some exchanges charge additional fees or markups when converting between currencies, which can be hidden in the spread.

Many exchanges offer reduced fees for high-volume traders. Some platforms even provide fee discounts for using their native tokens.

To obtain lower fees, compare the total cost, not just the stated fee percentage. Also, consider the tradeoff between convenience and cost; user-friendly exchanges for beginners often charge higher fees.

Always review the complete fee schedule before choosing an exchange, paying special attention to the fees for the specific cryptocurrencies and transaction types you plan to use most frequently.

4. Available Cryptocurrencies

While most exchanges offer popular cryptocurrencies like Bitcoin and Ethereum, the availability of altcoins varies significantly between platforms.

Your choice of exchange should align with your investment interests. At a minimum, ensure the exchange offers major cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Solana (SOL)

- Cardano (ADA)

If you’re interested in smaller, newer cryptocurrencies with growth potential, check if the exchange regularly adds new listings. Some exchanges are much more selective than others.

Consider whether the exchange offers direct trading between the cryptocurrencies you’re interested in. Limited trading pairs might require multiple transactions (increasing fees) to move between specific cryptocurrencies.

Many exchanges now offer ways to earn passive income on your cryptocurrency holdings through staking, lending, or savings products. Check which cryptocurrencies are eligible for these programs if passive income interests you.

As a beginner, it is advisable to start with established cryptocurrencies. However, having access to a broader selection allows for portfolio diversification as you gain experience.

Exchanges like Coinbase offer around 100 cryptocurrencies, while platforms like Binance or KuCoin offer 300+ options for those seeking more variety.

5. Educational Resources

The cryptocurrency market evolves rapidly, making ongoing education essential for successful investing. Exchanges that prioritize user education can significantly improve your experience and confidence.

Valuable Educational Features:

- Knowledge Base:

Comprehensive articles explaining cryptocurrency concepts, blockchain technology, trading strategies, and security best practices. Look for content specifically designed for beginners.

- Video Tutorials:

Step-by-step visual guides for navigating the exchange interface and completing everyday tasks. Video content often makes complex concepts more accessible for visual learners.

- Market Analysis Tools:

Real-time charts, technical indicators, and market news help inform your trading decisions. Some exchanges provide annotated examples explaining how to interpret this information.

- Earn-to-Learn Programs:

Platforms like Coinbase offer small amounts of free cryptocurrency for completing educational modules, incentivizing learning while providing hands-on experience with various digital assets.

- Community Forums:

User communities where you can ask questions, share experiences, and learn from more experienced traders. Active moderator participation indicates the exchange’s commitment to user support.

- Webinars and Live Events:

Regular educational sessions with cryptocurrency experts covering various topics from beginner basics to advanced trading strategies.

How to Buy and Use Cryptocurrencies on an Exchange

Once you’ve selected a suitable exchange, you’ll need to complete several steps before making your first cryptocurrency purchase. This step-by-step guide will walk you through the entire process from registration to trading.

Recognizing a Reputable Crypto Trading Platform

With hundreds of cryptocurrency exchanges available worldwide, identifying trustworthy platforms is essential for protecting your investment. This section will help you distinguish between reputable exchanges and potentially risky ones.

Red Flags to Avoid

When evaluating cryptocurrency exchanges, watch out for these warning signs that might indicate potential problems:

Security Concerns

- No mention of security measures on their website

- Lack of Two-Factor Authentication options

- No information about cold storage practices

- History of security breaches without transparent responses or remediation

- Excessive promises of account security without specific details

Operational Red Flags

- Extremely high returns or “guaranteed profits” (common in scams)

- Unusually low fees compared to industry standards (may indicate hidden costs)

- Pressure tactics urging immediate deposits or investments

- Vague or missing information about the company’s leadership team

- No physical address or unclear regulatory status

- Recently established with a limited track record or user reviews

User Experience Warning Signs

- Poor website design with broken links or spelling errors

- Limited or non-existent customer support options

- Excessively negative user reviews mentioning withdrawal problems

- Lack of transparency about fees and policies

- No educational resources or guidance for users

Financial Stability Questions

- No information about company funding or financial backing

- Unclear fee structure with hidden charges

- No published audit reports or financial transparency

- Excessive focus on their token rather than established cryptocurrencies

If you encounter multiple red flags during your research, consider it a strong indication to look elsewhere, regardless of attractive promotional offers or marketing claims.

Checklist of Reputable Platform Traits

Use this checklist to evaluate whether a cryptocurrency exchange meets the standards of a trustworthy platform:

Regulatory Compliance:

Licensed or registered with the appropriate financial authorities

- Complies with Anti-Money Laundering (AML) regulations

- Implements comprehensive Know-Your-Customer (KYC) procedures

- Transparent about the jurisdictions where they operate

- Clear terms of service and privacy policy

Security Framework:

- The majority of assets are stored in cold storage (offline)

- Mandatory Two-Factor Authentication (2FA)

- Regular security audits by third-party firms

- Insurance coverage for digital assets

- Advanced withdrawal security features

- Transparent incident response history

Operational Excellence:

- Established history of at least 2-3 years in the market

- Transparent fee structure with all costs disclosed

- Substantial daily trading volume indicates market liquidity

- Clear information about the founding team and leadership

- Multiple fiat currency support and payment methods

- Regular platform updates and technology improvements

User Support and Resources:

- Multiple customer support channels (chat, email, phone)

- Comprehensive FAQ and help center

- Educational resources for different knowledge levels

- Active community forums or discussion platforms

- Responsive technical support with reasonable resolution times

- Transparent process for dispute resolution

Trading Features:

- Intuitive user interface with both basic and advanced options

- Mobile app availability with high ratings

- A variety of order types for different trading strategies

- Adequate liquidity across trading pairs

- Reasonable trading limits that increase with account verification

- Competitive fee structure compared to industry standards

The more items a platform can check off this list, the more likely it is to represent a reputable exchange worthy of your consideration.

Remember that no exchange is perfect, but established platforms like Coinbase, Kraken, Gemini, and Binance typically meet most of these criteria.

Key takeaway – conclusion

This article helps beginners to find the most reliable crypto exchanges. This guide compares the top CEXs like Coinbase, Binance, and Crypto.com based on fees, features, and security.

Learn how to start trading safely, explore staking, and find beginner-friendly platforms to grow your crypto knowledge with confidence.

Most reliable Crypto Exchanges

Find out about our highest-rated crypto exchanges where you can purchase coins for betting.

How Much Money Do I Need to Start Trading Cryptocurrency?

Most exchanges allow you to start with as little as $5-$10, although some have minimum purchase requirements of $25-$50. Starting small is recommended for beginners to learn the process with minimal risk.

Do I Need to Buy a Whole Bitcoin to Get Started?

No, you can purchase a fraction of a Bitcoin or any cryptocurrency. For example, you can buy 0.001 BTC or even less on most exchanges.

How Long Does the Verification Process Usually Take?

Basic verification typically takes minutes, while complete identity verification can take anywhere from a few hours to several days, depending on the exchange and current demand.

Can I Use Cryptocurrency Exchanges If I Don’t Have a Bank Account?

Yes, many exchanges accept credit/debit cards, PayPal, or cash deposits through services like Western Union. However, bank transfers often offer the lowest fees and highest limits.

What Happens If a Cryptocurrency Exchange Gets Hacked?

It depends on the exchange’s policies and insurance coverage. Some exchanges maintain reserve funds to reimburse users in case of security breaches, while others may not offer any compensation.

This highlights the importance of choosing reputable exchanges with strong security measures.

Is It Safe to Keep My Cryptocurrency on an Exchange?

Exchanges are generally safe for temporary storage and active trading, but for long-term holding of significant amounts, a personal wallet offers better security since you control the private keys.

What’s the Most Secure Way to Access My Exchange Account?

Use a dedicated device or browser with updated security software, enable all available security features, use a unique and strong password, and always access the exchange through bookmarked official URLs rather than clicking on links in emails.

He has worked with several companies in the past including Economy Watch, and Milkroad. Finds writing for BitEdge highly satisfying as he gets an opportunity to share his knowledge with a broad community of gamblers.

Nationality

Kenyan

Lives In

Cape Town

University

Kenyatta University and USIU

Degree

Economics, Finance and Journalism

Facts Checked by Josip Putarek

Fact checked by

Fact checked by

eabungana@gmail.com

eabungana@gmail.com