What Influences Cryptocurrency Prices?

Understanding what influences cryptocurrency prices is crucial before making predictions, as the crypto market is highly volatile and driven by multiple factors. Knowing these drivers will help you interpret price fluctuations more realistically and avoid speculative forecasts.

So, let’s explore the major factors:

1. Supply and Demand:

Bitcoin’s fixed supply of 21 million coins creates scarcity, which reinforces its “digital gold” narrative by positioning it as a deflationary asset. While BTC can’t be diluted over time, inflationary fiat currencies rely on banks, which can increase supply and decrease their purchasing power.

2. Market Sentiment:

Social media platforms, like X/Twitter, Reddit, etc., act as an echo chamber that can turn a minor news story into a massive price rally or a crash. This is because a small rumour spreads extremely fast, directly impacting cryptocurrency price predictions.

3. Regulatory Environment:

Institutional legitimacy is one of the key drivers for crypto price predictions. “Pro-crypto” frameworks, like MiCA or ETF approvals, attract big capital because they provide legal clarity, while sudden bans or lawsuits, such as SEC actions, trigger immediate liquidity exits.

4. Technological Advancements:

Tech innovations increase cryptocurrencies’ value by improving their real-world utility and scalability. More precisely, major upgrades like Ethereum’s “Merge” or Layer 2 developments increase a network’s value by making it faster, cheaper, or more environmentally friendly, which supports wider adoption and long-term demand.

5. Macro Trends:

Crypto markets are connected to the global economy, as well as investor risk appetite. Connect crypto to the global economy. In periods when there’s high inflation or interest rate hikes by central banks, like the Fed, investors shift away from “risk-on” assets like crypto toward safer havens.

6. On-Chain Activity:

Ultimately, this emphasizes crypto’s transparency by allowing anyone to track whale movements and real network usage in real-time. This provides a “truth layer” that prevents pure speculation and grounds price analysis on actual data and behavior.

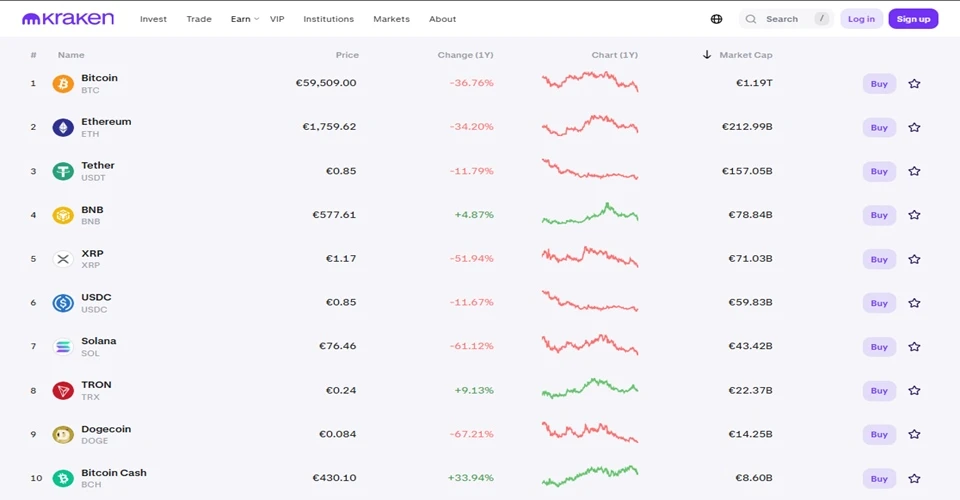

Image Source: https://www.kraken.com/price-prediction

Price Analysis Methods – Explained

Price analysis methods used in crypto markets are based on long-established principles of market behavior that have been adapted to digital assets over time. Here’s what traders and analysts use to make crypto predictions:

Fundamental Analysis

Unlike standard stock metrics, cryptocurrencies lack traditional quarterly reports. That’s why a unique analytical approach is necessary, so you can find an asset’s intrinsic value by combining project-specific factors with broader global economic conditions.

- Intrinsic Value Assessment: This approach involves analyzing qualitative factors, such as management transparency and market conditions, to determine if a coin is overvalued or undervalued.

- Macro & Project Evaluation: This evaluation considers how broad economic trends and the updates from the founding team impact the long-term viability of the asset.

1. On-Chain Data

On-chain metrics act as a “live audit” of a blockchain’s health, allowing investors to verify network activity directly without the technical burden of running a personal node.

- Network Throughput & Volume: You can use transaction counts and values as indicators of usage. More precisely, high throughput can suggest strong demand and real-world utility, while low throughput may indicate stagnation. However, these numbers can be artificially inflated by internal transfers, meaning they can often be misleading.

- User Adoption Levels: Tracking “Active Addresses” helps analysts measure the actual growth of the user base and unique network participants over time. As a result, they can see whether adoption is increasing, stable, or declining, which can be an indicator of the coin’s long-term value.

- True Market Demand: “Fees Paid” is a superior metric for gauging urgent demand. Basically, users only pay higher fees when they prioritize network space, which is a more accurate metric than just counting raw transaction counts.

- Security & Participation Integrity: Analysts can measure the network’s overall security and the growing interest of miners or investors by using the hash rate for PoW or staking levels. Simply put, higher hash rates show stronger protection against attacks, whereas larger participation reflects investor confidence and long-term commitment.

2. Project Metrics

Project metrics are used to evaluate the qualitative strength and long-term credibility of a cryptocurrency project.

- Team & Governance: Team transparency, experience, and active development ensure long-term project credibility.

- Tokenomics & Utility: Token usage and supply design influence long-term sustainability and support ongoing demand.

- Market Position & Competition: Comparing similar projects helps assess differentiation and relevance within the crypto market.

3. Financial Signals

Financial signals help describe a cryptocurrency’s market presence, activity level, and supply structure at a high level.

- Market Size (Market Capitalization): Market capitalization is a way for traders and analysts to compare relative size and maturity between cryptocurrencies. However, this is not an exact valuation of the coin.

- Market Activity (Liquidity & Volume): Liquidity and trading volume reflect how actively a cryptocurrency is traded and how easily you can buy it or sell it.

- Supply Structure: Maximum supply, circulating supply, and issuance rules shape long-term market expectations, as they directly affect the scarcity, inflation, and investor expectations.

Using Technical Analysis for Price Predictions

Technical analysis examines historical price movements to identify trends and potential future scenarios. However, it’s trend-based, interpretative, and not fully reliable on its own.

What Technical Analysis Focuses On

- Historical Price Trends and Momentum: Examines past price movements so that it can make more accurate cryptocurrency predictions based on potential future direction.

- Key Price Levels Where Buying or Selling Pressure Appears: Focuses on the support and resistance levels that highly influence trading decisions.

- Market Behavior During Different Phases: Observes patterns in uptrends, downtrends, and consolidation to see how prices react in each phase.

Limits of Technical Analysis

While technical analysis is thorough, it also has limitations. This type of analysis is subjective, depends on interpretation, and past price behavior does not guarantee future results.

How Technical Analysis Is Used in Price Forecasts

Technical analysis is used in a crypto forecast as a supporting input alongside fundamentals and market sentiment. This helps analysts frame possible price scenarios, but not exact predictions.

Market Sentiment in Crypto Markets

For those looking for another method on how to predict cryptocurrency prices, market sentiment reflects the collective emotions, expectations, and perceptions of market participants. Due to this, it can influence crypto price movements.

What Market Sentiment Represents

- Overall Optimism or Pessimism Toward a Crypto Asset: The market sentiment reflects whether investors feel positive or negative about the coin’s lookout.

- Investor Reactions to News, Narratives, and Public Perception: It also shows how various events and opinions influence buying or selling behavior.

- Shifts in Confidence During Market Cycles: Ultimately, the market sentiment captures the changes in trust and risk appetite as markets rise or fall.

Why Market Sentiment Matters

Market sentiment matters because strong emotional reactions can amplify price movements and accelerate market trends, especially when we’re speaking about the volatile crypto markets.

Limitations of Sentiment-Based Analysis

Despite the positive aspects, sentiment-based analysis has some limitations, mainly arising from the sentiment changing quickly. That’s why you shouldn’t view it in isolation, but rather as one input alongside fundamentals and technical perspectives.

Conclusion

Crypto price predictions combine fundamentals, technical context, and market sentiment to outline possible scenarios – not exact outcomes!

Due to the market’s volatility and uncertainty, these forecasts are highly speculative and intended for reference only.

Investors should understand potential trends and directional movements – not expect guaranteed results.

Frequently Asked Questions

How accurate are crypto price predictions?

The accuracy of crypto price predictions varies depending on whether you’re interested in short-term or long-term forecasts. They can help you understand the direction in which a certain coin is moving, but they cannot predict exact prices with high precision.

Which algorithm is best for crypto prediction?

The best algorithm for crypto prediction is based on whether you’re analyzing short-term or long-term trends. However, Long Short-Term Memory (LSTM) networks, which are a type of deep learning, are considered great for capturing the complex, non-linear, time-dependent nature of crypto prices.

How to predict cryptocurrency spikes?

To predict cryptocurrency spikes, you can use three different analysis methods, such as fundamental, technical, and sentiment analysis. Each of them focuses on different aspects of the crypto landscape and comes with both advantages and limitations. Therefore, it’s best if you combine them for the most accurate results.

A pro writer since 2015, immersed in the world of crypto since 2016, Will built up a wealth of knowledge and experience in both crypto gambling and crypto betting, making him one of the most prominent voices in the industry. His high-quality reviews have been featured on prominent gaming platforms, making him a trusted authority in the field.

Nationality

British

Lives In

England

Facts Checked by Eugene Abungana

Fact checked by

Fact checked by

will.wood.9964@gmail.com

will.wood.9964@gmail.com