Best Crypto & Bitcoin Casinos – July 2025

Top 10 BTC Casino Sites Reviewed by Bitedge

Below, we review the top 10 Bitcoin gambling sites on our list. Each mini-review covers licensing and security, anonymity (VPN and KYC policies), payments, bonuses, game selection, and overall user experience. We highlight what makes each Bitcoin gambling site unique, along with key pros and cons.

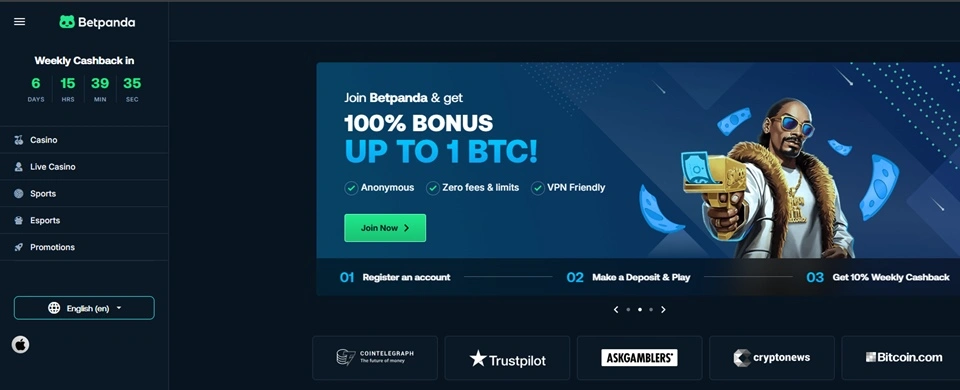

1. Betpanda – Best for Anonymous Gambling with No Withdrawal Limits

Betpanda is an anonymous, instant crypto operator launched in 2023 that prioritizes privacy. It operates under a Costa Rican license, allowing it to accept players without KYC verification.

You can sign up with just an email and remain private as long as you play responsibly.

- Security: Despite its anonymity, Betpanda maintains robust security via SSL encryption and 2FA for logins.

- Cryptocurrencies: It supports over 10 cryptocurrencies for payments, including BTC, ETH, LTC, USDT, and more.

- Payments: Deposits appeared within a single blockchain confirmation, and payouts hit our wallet well under the promised 24 hours.

- User Experience: We found the site’s performance snappy and reliable during our tests

💰 Welcome bonus: 100% match up to 1 BTC + 10% weekly cashback on losses.

This bonus can be huge for high rollers; 1 BTC is a hefty sum. You can cash out large crypto winnings in one go, subject to liquidity and security checks.

In our Betpanda review, we found customer support to be responsive via 24/7 live chat. We inquired about withdrawal limits and were told there are effectively no withdrawal limits.

-

Pros

-

No-KYC registration—completely anonymous play for privacy-conscious users

No-KYC registration—completely anonymous play for privacy-conscious users -

Instant BTC deposits via Lightning and fast withdrawals (usually within minutes)

Instant BTC deposits via Lightning and fast withdrawals (usually within minutes) -

Huge gage library with more than 5,000 titles

Huge gage library with more than 5,000 titles

-

Cons

-

Restricted in some countries, especially the US/UK

Restricted in some countries, especially the US/UK -

High wagering requirement (50x) on the welcome bonus makes it tough to clear

High wagering requirement (50x) on the welcome bonus makes it tough to clear

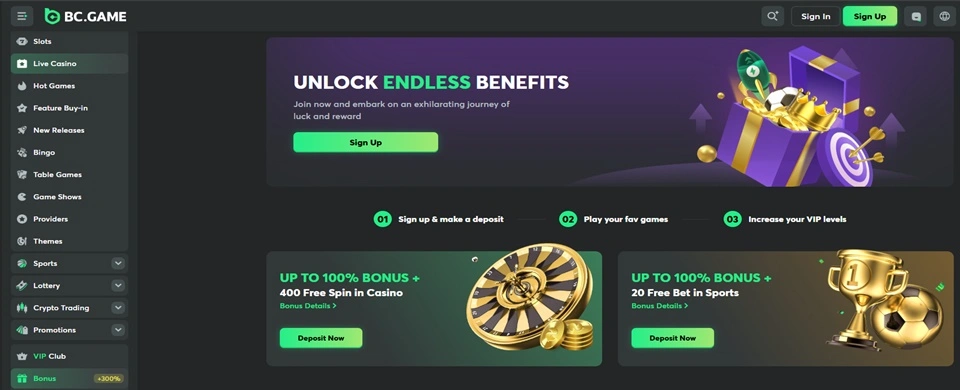

2. BC.Game – Largest Variety of Crypto Payment Options

BC.Game is a household name in the crypto world since 2017, owned by Twocent Technology Limited, and operating under the Anjouan Gaming License. It offers a wide range of games, including slots, crash games, and live dealer games.

- Security: SSL encryption, 2FA for account safety, and cold storage wallets.

- Cryptocurrencies: It accepts 150+ different cryptos, more than any other site on our list; Additionally, it even has its native coin, the BCD token, which fuels an interactive loyalty economy. This breadth of options makes it the best crypto gambling site for players who hold various coins and want to use them all in one place.

- Payments: Deposits and withdrawals are processed instantly.

- Registration: Signing up is quick (an email or social login), and while the site is largely no-KYC, note that some withdrawals or large wins might trigger an ID check.

💰 BC.Game’s 1st Deposit Bonus: 120% matched deposit bonus up to $500 + 100 Free Spins

Yet, that’s not all! In our BC.Game review, we found that it shines with its promotions. Instead of a standard one-time bonus, new players get a tiered welcome package worth up to $1,600 and 400 Free Spins in total across the first four deposits.

-

Pros

-

150+ cryptocurrencies supported, including native token BCD

150+ cryptocurrencies supported, including native token BCD -

Provably fair games and strong community features

Provably fair games and strong community features -

Wide range of original instant win games

Wide range of original instant win games

-

Cons

-

Bonus wagering requirements are steep at 45x

Bonus wagering requirements are steep at 45x -

The sheer number of features and coins can be overwhelming for newcomers

The sheer number of features and coins can be overwhelming for newcomers

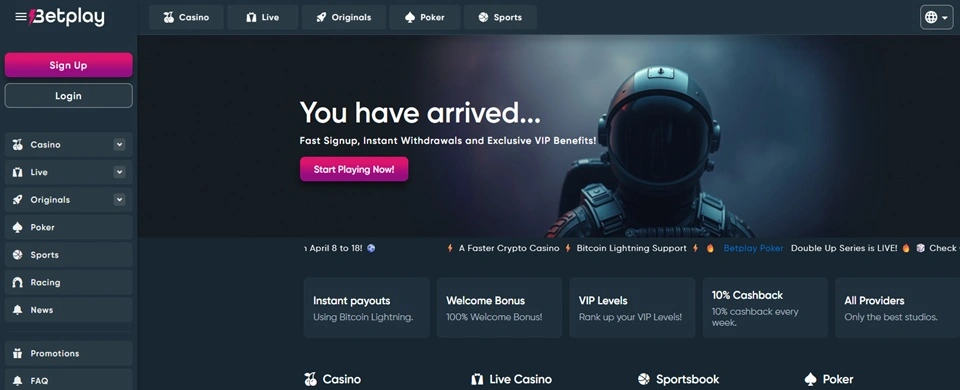

3. Betplay – Best for Secure No-KYC Gambling

Betplay is a highly secure crypto site that was established in 2020. It stands out for allowing completely anonymous gambling while still maintaining a solid reputation for fairness and security.

- Security: We were pleased to see that Betplay uses SSL encryption and two-factor authentication for account login, demonstrating a commitment to player safety.

- Cryptocurrencies: BTC, ETH, LTC, DOGE, BCH, BNB, TRX, USDT, USDC, SHIB, SAND, XMR, BUSD.

- Payments: Instant payouts using Bitcoin Lightning.

- Games: The game selection at Betplay includes 2,000+ games from top providers like BGaming, Betsoft, and Evolution Gaming. This is smaller than some rivals with 5,000+ games, but there are still plenty to choose from.

💰 Betplay’s welcome bonus: 100% match up to 5,000 USDT or the equivalent in BTC.

In our Betplay review, we found that it doesn’t display a known license, but it is run from Costa Rica with a corporate identification number: 3-102-857685. This allows it to legally provide casino services without requiring mandatory Know Your Customer (KYC) procedures.

-

Pros

-

Completely anonymous, no-KYC operator - privacy-focused and VPN-friendly

Completely anonymous, no-KYC operator - privacy-focused and VPN-friendly -

Focus on crypto poker and high-quality table games

Focus on crypto poker and high-quality table games -

Fast withdrawals with no fees and no withdrawal limits for crypto transactions

Fast withdrawals with no fees and no withdrawal limits for crypto transactions

-

Cons

-

Game library is smaller than some competitors with massive catalogs

Game library is smaller than some competitors with massive catalogs -

High bonus wagering of 80x

High bonus wagering of 80x

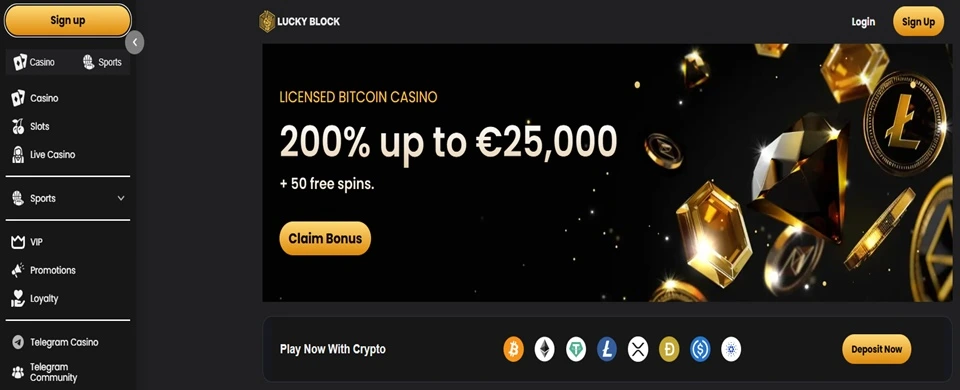

4. Lucky Block – Most Rewarding Crypto Site with Native Token

Lucky Block burst onto the scene in early 2023 and quickly became one of the best crypto sites for players seeking huge bonuses and modern features. The operator is licensed and regulated by the Government of the Autonomous Island of Anjouan and operates under License No. ALSI-1423 l 1005-FI2.

It was originally launched alongside the Lucky Block (LBLOCK) cryptocurrency token and a crypto lottery project. It has since evolved into a full-featured crypto operator that welcomes players worldwide with no KYC required.

- Security: SSL encryption and 2FA for logins

- Cryptocurrencies: Bitcoin, Ethereum, Tether, Solana, Dogecoin, Binance, Tron, Cardano, USDC, Ripple, and more

- Payments: Instant crypto deposits; withdrawal was processed within 2 hours

- Loyalty Program: Invite-only, but even regular players benefit from occasional free spin drops and reload bonuses emailed on special occasions.

💰 Lucky Block’s welcome bonus: 200% up to €25,000 and 50 free spins. That’s a massive max bonus compared to what some competitors offer.

Beyond the welcome offer, Lucky Block keeps players engaged with regular tournaments and giveaways. For example, in our Lucky Block review, we found they’ve hosted slot tournaments with prize pools in BTC and prize draws where players can win high-end gadgets or more crypto.

-

Pros

-

No KYC and VPN-friendly, which is easy access for players worldwide, including the US

No KYC and VPN-friendly, which is easy access for players worldwide, including the US -

Native token LBLOCK and popular cryptocurrencies offered

Native token LBLOCK and popular cryptocurrencies offered -

Live chat customer support available 24/7

Live chat customer support available 24/7

-

Cons

-

As a newer website, it's still building a long-term reputation.

As a newer website, it's still building a long-term reputation. -

High bonus amounts come with high wagering requirements

High bonus amounts come with high wagering requirements

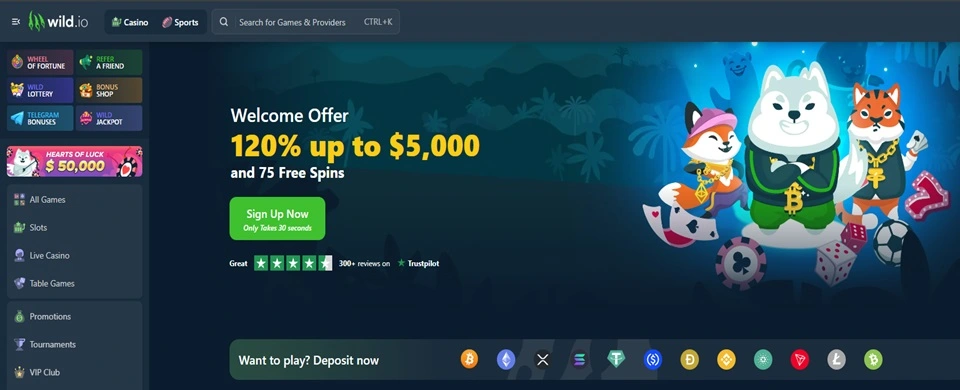

5. Wild.io – Most Transparent Crypto-Only Casino

Wild.io is a crypto-exclusive operator that has quickly gained attention for its incredibly generous bonuses and commitment to fair gaming. Launched in 2022 under a Curaçao Gaming Authority license, Wild.io caters solely to cryptocurrency users; you won’t find any fiat payment options here, which means the entire site is optimized for crypto gambling.

- Security: Full SSL encryption and an option to enable 2FA.

- Cryptocurrencies: It accepts BTC, ETH, LTC, XRP, ADA, DOGE, USDT, BNB, BCH, TRX, and more.

- Provably fair: In its games, but also by publishing data on the site’s average return to player (RTP) percentages. The platform is transparent about using slots from verified providers and clearly states that they do not manipulate RTP.

- VIP program: It’s an invite-tier system tailored for high rollers; loyal players get increasing perks like higher cashback, exclusive bonuses, and even a personal account manager.

💰 Wild’s welcome offer: 120% matched deposit bonus up to $5,000 + 75 Free Spins

Beyond the welcome deal, our Wild.io review found it also rewards players with reload bonuses and cashback. For example, they run weekly reloads and have a tiered cashback of up to 20% for VIP members.

-

Pros

-

Welcome package of 350% in Bonuses and 200 Free Spins

Welcome package of 350% in Bonuses and 200 Free Spins -

Offers many provably fair games and transparency, enhancing trust for crypto gamblers

Offers many provably fair games and transparency, enhancing trust for crypto gamblers -

Fast payouts, no fiat complications, and generally no KYC required for withdrawals

Fast payouts, no fiat complications, and generally no KYC required for withdrawals

-

Cons

-

High wagering requirement for the bonus

High wagering requirement for the bonus -

Limited RG tools

Limited RG tools

6. Mega Dice – Top Telegram Casino with Easy Mobile Play

Mega Dice made headlines as the world’s first licensed Telegram casino, allowing users to play casino games directly via a Telegram bot. Launched in 2023, Mega Dice is a forward-thinking crypto casino that blends the convenience of messaging apps with a full gambling platform.

- Security: It operates under a Curaçao Gaming Authority license and, like others on our list, does not require KYC for crypto gamblers.

- Cryptocurrencies: BTC, BCH, USDT, LTC, XRP, DOGE, ADA, TRX, and more.

- Payments: Deposits and withdrawals are processed instantly

- Games: A vast collection of more than 3,000 titles offered by 40+ top software providers such as Spinomenal, Red Tiger, NoLimitCity, and Evolution.

💰 Mega Dice welcome offer: 200% matched deposit bonus up to 1 BTC + 50 Free Spins

In our Mega Dice review, we found that its claim to fame is the ability to register and gamble simply by interacting with “@MegaDiceBot” on Telegram. However, you can also use their standard web platform. This unique approach has made Mega Dice extremely easy to access on mobile and highly popular among players who prefer using crypto on the go.

-

Pros

-

First Telegram-based casino

First Telegram-based casino -

Generous welcome offer: 200% up to 1 BTC + 50 free spins gives a big bankroll boost

Generous welcome offer: 200% up to 1 BTC + 50 free spins gives a big bankroll boost -

Strong focus on innovation: native $DICE token, extra cashback, and tech-forward features like bot gaming

Strong focus on innovation: native $DICE token, extra cashback, and tech-forward features like bot gaming

-

Cons

-

The Telegram interface, while novel, might feel limited for complex games

The Telegram interface, while novel, might feel limited for complex games

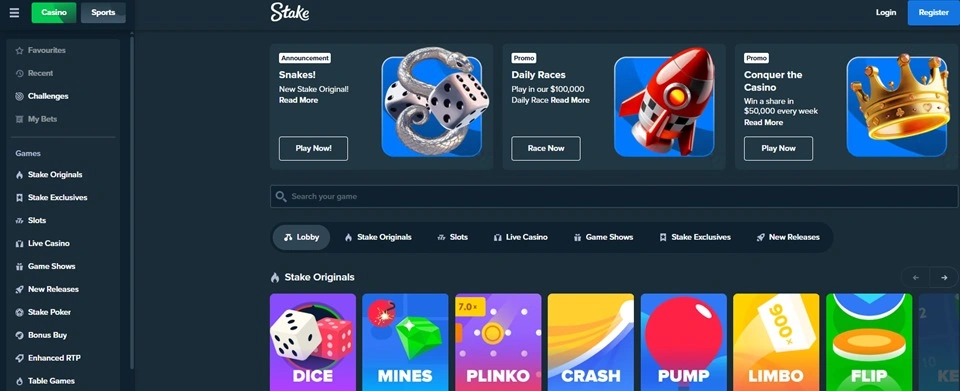

7. Stake – Best Crypto Gambling Site for VIP perks and Original Games

Stake is arguably the most famous name in crypto gambling. Founded in 2017 by the creators of Primedice, Stake.com has grown into a crypto casino powerhouse known for its high-roller community, celebrity endorsements, and a huge variety of original games.

- Security: With a Curaçao Gaming Authority license, Stake has built a reputation for reliability and transparency. It’s the chosen platform for millions of players and even big names like rap star Drake. If you’re looking for a trusted Bitcoin gambling site with provably fair games and top-tier VIP perks, Stake leads the pack.

- Cryptocurrency: 20+, including BTC, LTC, DOGE, ETH, BCH, and USDT.

- Provably fair: Provably fair originals are simple, highly entertaining games exclusive to Stake, e.g., Stake Dice, Crash, Mines, Limbo, Plinko, Slide, and more.

- VIP Reward: A system that is incredibly rewarding for active players

💰 Stake’s bonus offer: Exclusive Bitedge bonus offer of a 200% matched bonus of up to $3000

In our Stake Casino review, we found that the casino’s game selection is massive. It has over 3,000 games from standard providers, but the crown jewels are 50+ exclusive titles.

-

Pros

-

Best VIP program in crypto gambling

Best VIP program in crypto gambling -

Stake is a proven platform with huge payouts under its belt

Stake is a proven platform with huge payouts under its belt -

Wide range of provably fair games and exclusive content

Wide range of provably fair games and exclusive content

-

Cons

-

No traditional welcome bonus for new players

No traditional welcome bonus for new players -

Players from some regions (US, UK, Australia) are geo-blocked

Players from some regions (US, UK, Australia) are geo-blocked

8. WSM Casino – Best VPN-Friendly Crypto Casino with Huge Welcome Bonus

WSM Casino is a newcomer that launched in late 2023, riding the popularity of the Wall Street Memes ($WSM) meme coin. It’s a hybrid gambling platform powered by its community-driven token.

WSM Casino leverages the large following of Wall Street Memes (a social media and crypto community), combining it with a robust gambling site that offers thousands of games, where a crypto token ecosystem is tied into the casino’s rewards.

- Security: As a Curaçao Gaming Authority-licensed operation, it reserves the right to request verification if needed.

- Cryptocurrencies: 20+, including BTC, ETH, ADA, XRP, and native token $WSM Coin

- Payments: Crypto-only with WalletConnect for faster transactions

- Accessibility: The site is accessible globally, with a few restricted countries

💰 WSM’s bonus offer: A 200% deposit match up to $25,000 + 50 free spins. This is on par with Lucky Block’s offer and clearly positions WSM among the best crypto gambling sites for bonus value.

WSM Casino has attracted attention for its huge welcome bonus and blend of meme culture with real gambling products. The Casino is also VPN-friendly and does not enforce strict KYC, in most cases.

-

Pros

-

Huge 200% up to $25,000 welcome bonus + free spins and bets

Huge 200% up to $25,000 welcome bonus + free spins and bets -

Backed by a popular crypto community (Wall Street Memes)

Backed by a popular crypto community (Wall Street Memes) -

VPN-friendly

VPN-friendly

-

Cons

-

Very new brand (2023)—still in the process of proving long-term trustworthiness (though no red flags so far)

Very new brand (2023)—still in the process of proving long-term trustworthiness (though no red flags so far) -

The meme theme might not appeal to those who prefer a more traditional casino aesthetic

The meme theme might not appeal to those who prefer a more traditional casino aesthetic

9. TG.Casino – Top Destination for High-Rollers and DeFi Enthusiasts

TG.Casino is another 2023 entrant that merges a crypto casino with the power of social messaging. It allows sign-up via Telegram. Additionally, it offers casino games and live dealers focused on a high-roller welcome bonus and token-based profit sharing. It has rapidly gained traction among players looking for the next big thing.

- Security: Licensed by the Gaming Curaçao with strong encryption standards.

- Cryptocurrencies: 10+, including native token – $TGC

- Registration: Uses Telegram for quick registration; with a couple of taps on the Telegram bot, you can create an account without filling out lengthy forms.

- Privacy: No immediate KYC; you can deposit and play anonymously.

💰 TG.Casino bonus offer: 200% bonus up to 10 ETH + 50 free spins, tailor-made for big spenders.

Our TG.Casino review found that its standout feature is its unique $TGC token and staking mechanism. Purchasing or earning $TGC tokens means you can stake them on the platform to receive a share of the casino’s profits.

Essentially, TG.Casino redistributes some house earnings back to token stakers as a form of a dividend, creating an interesting blend of Bitcoin gambling and DeFi. This means, as a player, you can both gamble and invest in the casino’s success.

-

Pros

-

Lucrative 200% up to 10 ETH welcome bonus; excellent for high-rollers

Lucrative 200% up to 10 ETH welcome bonus; excellent for high-rollers -

$TGC staking with profit sharing

$TGC staking with profit sharing -

Easy account creation via Telegram

Easy account creation via Telegram

-

Cons

-

The dual casino/investment aspect (staking) might be complex for users who just want simple crypto gambling

The dual casino/investment aspect (staking) might be complex for users who just want simple crypto gambling

10. Roobet – Most Trusted Bitcoin Gambling Site for Provably Fair Games

Roobet is a veteran in the crypto casino space, operating since 2019 and carving out a niche as a fun, trustworthy platform. Known for its kangaroo mascot, “Roo,” and slogan, “Crypto’s Fastest Growing Casino,” Roobet offers a vast array of casino games. Despite its playful branding, Roobet runs a tight ship when it comes to fairness and security.

- Security: It’s fully licensed by the Curaçao Gaming Authority and is one of the more established Bitcoin casino sites beloved by the community.

- Cryptocurrencies: BTC, USDT, USDC, ETH, XRP, TRX, LTC, and DOGE

- Payments: Instant; partnered with Moonpay for ‘buy crypto’ option

- Games: It has a selection of provably fair original games from its early days, notably “Crash,” “Mines,” and “Towers,” which helped build its reputation. These simple blockchain-verifiable games became extremely popular among crypto gamblers.

💰 Roobet bonus offer: It focuses on ongoing promotions and VIP rewards.

Over time, Roobet expanded into thousands of traditional casino games. Today, you’ll find over 3,000 games, including slots from top providers, live dealer tables, game shows, and more. Roobet also made headlines by partnering with Snoop Dogg, adding star power to its brand.

-

Pros

-

Well-established and trusted—Roobet has years of operation with a strong community and is known to pay out reliably

Well-established and trusted—Roobet has years of operation with a strong community and is known to pay out reliably -

Offers both provably fair games and a huge library of traditional games

Offers both provably fair games and a huge library of traditional games -

Slick experience with a celebrity partnership (Snoop Dogg) and unique content

Slick experience with a celebrity partnership (Snoop Dogg) and unique content

-

Cons

-

No large welcome bonus by default

No large welcome bonus by default -

KYC and regional restrictions have increased over time

KYC and regional restrictions have increased over time

Why Choose Crypto Casinos Instead of Fiat Casinos?

Bitcoin gambling offers a fresh alternative to traditional fiat-based casinos, and the main differences boil down to privacy, speed, and control:

👤 In a fiat casino, you typically must undergo identity verification and share personal banking details. By contrast, BTC gambling lets you play anonymously. Often, just an email is needed, with no intrusive KYC checks.

⏱️ Crypto transactions are peer-to-peer and fast, meaning deposits and withdrawals can be processed within minutes instead of days, which bank transfers can take.

💸 Fees also tend to be lower or nonexistent; you pay only a small blockchain network fee rather than hefty payment processing fees. Moreover, crypto transactions are irreversible, protecting casinos from chargeback fraud and enabling them to offer bigger bonuses.

🌍 While fiat casinos are bound by bank holidays and intermediaries, BTC gambling sites operate 24/7 worldwide.

Traditional casinos still have the edge of long-established regulation and familiarity,

but when it comes to anonymity and efficiency, crypto gambling sites hold the high cards.

How to Choose the Best Crypto Casino? Sneak a Peek at Our Methodology

To find the best crypto gambling site for your needs, you should evaluate platforms on important criteria. At Bitedge, we use a comprehensive methodology when reviewing crypto gambling sites.

Here’s a sneak peek at the key factors we consider, and you should too:

Best VPN-friendly Casinos

For players who live in regions where access to online gambling is restricted or for those who just want extra privacy, using a VPN (Virtual Private Network) is common. However, not all of them are VPN-friendly casinos.

| Casino |  Betpanda.io Betpanda.io |  Wild.io Casino Wild.io Casino |  Betplay.io Betplay.io |

| Bonus | 100% Bonus Up To 1 BTC + 10% Weekly Cashback | Welcome Bonus 120% Up To $5,000 +75 Free Spins | 100% bonus of up to 50 mBTC |

| Payment Types | 9+ Methods    | 7+ Methods    | 13+ Methods    |

| Licenses | license | ||

| Play Now |

Advantages of Crypto Gambling

Using cryptocurrency for online gambling brings several advantages over traditional fiat methods. Here are some of the top benefits of crypto gambling:

1. Lower Transaction Fees

One big perk of crypto gambling is the low cost of transactions. When you deposit or withdraw with Bitcoin or other coins, you typically only pay a minor network fee to miners.

- It’s often just a few cents or dollars, depending on the coin.

- In contrast, fiat casinos might charge withdrawal fees, or you might lose a percentage to payment processors.

2. Privacy and Anonymity

Privacy is a core benefit of crypto. When you gamble at the best Bitcoin gambling sites, you don’t need to reveal sensitive personal or financial information.

- Your crypto wallet doesn’t expose your name or address; it’s just an address on the blockchain.

- The best casinos for BTC gambling only ask for an email at signup, allowing you to remain virtually anonymous.

This means your crypto gambling activity isn’t tied to your identity in the way credit card transactions are, and you have peace of mind that your data won’t be leaked.

3. Faster Payments

Crypto transactions are lightning-fast compared to traditional banking.

- A Bitcoin or Ethereum deposit can be credited in minutes, and withdrawals are often processed just as quickly.

- This quick access to winnings is a huge plus.

Additionally, crypto is 24/7; you can deposit or cash out on weekends, holidays, or anytime without delays.

4. Better/Bigger Bonuses

Many crypto gambling sites can offer bigger bonuses and better odds, partly because their operating costs are lower.

- They don’t deal with high payment fees or the complex regulatory overhead of fiat, so they can allocate more to player promotions.

- It’s not uncommon to see the best Bitcoin gambling sites giving 1 BTC or more as a welcome bonus, which dwarfs typical $100 to $500 offers at fiat casinos.

Disadvantages of Gambling with Crypto

While using Bitcoin and other crypto has its perks, there are also drawbacks to consider in crypto gambling:

1. Crypto Volatility

The most glaring issue is cryptocurrency volatility. Crypto prices can swing wildly in short periods. For example, if you deposit 0.1 BTC to gamble, that might be worth $3,000 today, but tomorrow, it could be $2,700 or $3,300, depending on the market.

This means you might win in the casino, but if Bitcoin’s price drops, your winnings could lose value by the time you cash out. On the positive side, prices could also rise and amplify your gains.

Volatility adds an extra layer of risk that fiat money doesn’t have. Players must decide if they’re comfortable with their crypto gambling funds being tied to a fluctuating asset or consider using stablecoins (like USDT) to mitigate this.

2. Learning Curve and Need for Wallet or Exchange Account

New players face a learning curve: you need to acquire cryptocurrency first (which means using an exchange or broker), set up a crypto wallet to store your funds, and understand how to send transactions. Managing a wallet can be intimidating for newbies.

If you send funds to the wrong address or make a mistake, it could be irreversible. The need to securely store seed phrases and handle your own “bank” is empowering, but also a responsibility. In short, crypto gambling asks you to be at least mildly crypto-savvy.

3. Lack of Regulations

While the relative lack of strict regulation is what allows easy access and anonymity, it’s also a drawback in terms of consumer protection. Many crypto gambling sites operate offshore under lighter regulatory oversight.

This means if a crypto casino were to act dishonestly or go bust, players might have limited recourse. There’s no guarantee fund or regulator to immediately turn to, and you’re essentially trusting the operator’s reputation and the community’s word. That’s why doing your research and sticking to reputable sites is so important.

4. Irreversible Transactions

With crypto, transactions are final. If you send Bitcoin to the wrong wallet or a scam address, there’s no bank to call to reverse it. In the context of BTC gambling, this means you need to double-check deposit addresses and follow instructions carefully.

Irreversibility also means that chargebacks at the best Bitcoin gambling sites are impossible. While this is often framed as a benefit, it also means that if a rogue casino doesn’t pay you, you can’t claw the money back through a payment dispute.

Again, it circles back to trusting the casino. The blockchain’s “no take-backs” nature places more onus on players to be cautious and on casinos to be honest.

Comparison Table

How do Bitcoin gambling sites stack up against traditional online casinos? The table below highlights key differences:

Features | Fiat Casinos | Crypto Casinos |

| Privacy & Anonymity | Require full personal details and ID verification (KYC). No anonymity. | Often allows anonymous play with just an email; KYC is usually not required unless suspicious activity. |

| Security | Most sites protect your data and transactions through encryption. Standard varies by operator. | Blockchain technology adds an extra layer of security through advanced encryption. |

| Transaction Speed | Deposits via cards/e-wallets are fast; withdrawals can take days. | Crypto deposits/withdrawals are near-instant after network confirmation. |

| Fees | Possible banking fees, currency conversion fees, or casino withdrawal fees. | Minimal fees. Usually, no casino-imposed fees. |

| Regulation | Heavily regulated in many markets. | Looser regulations. |

| Game Variety | Extensive Range | More Limited |

| Game Fairness | Uses RNGs audited by regulators; trust in the operator’s license. | Uses RNGs and often provably fair games where players can verify outcomes on blockchain. |

| Bonuses | Typically, smaller bonuses. | Bigger bonuses, often thousands in crypto. |

| Payment Options | Credit/debit cards, bank transfers, e-wallets; no crypto support usually. | Bitcoin, Ethereum, and altcoins; some accept dozens of cryptos. A few also let you buy crypto on-site with a card. |

| Global Access | Restricted by country. VPN use is often forbidden by terms. | Generally accessible worldwide. VPN use is tolerated on many Bitcoin gambling platforms. |

| Withdrawal Limits | Often have monthly cashout limits for big wins. Large wins might be paid in installments. | Typically, very high or no explicit withdrawal limits, especially on established crypto gambling sites. |

| Community and Features | Less community interaction; traditional approach. | Active communities and innovative features. |

Popular Cryptocurrencies for Gambling

A variety of cryptocurrencies are used in online casinos. Here are some of the most popular cryptocurrencies for crypto gambling and a bit about each:

More Trending Cryptos

According to CoinMarketCap trends, other coins sometimes used in gambling include:

- Avalanche: Known for fast contracts.

- Shiba Inu: A popular meme token accepted by some sites after DOGE’s success.

- Stellar: Which, like XRP, offers quick and cheap transfers.

- Chainlink: Not a typical currency, but some operators accept it because many crypto holders own LINK.

- Litecoin: One of the earliest altcoins, called the “silver to Bitcoin’s gold,” valued for its speed and low fees.

What Bonuses Do BTC Gambling Sites Offer?

Crypto casinos are known for a variety of bonuses and promotions. Here are the common types of bonuses you’ll encounter at Bitcoin gambling sites, explained:

1. Welcome Bonus

In the crypto world, welcome bonuses often come as a deposit match, where the casino matches a percentage of your first deposit (or first few deposits) up to a certain amount.

For example, a 100% welcome bonus up to 0.1 BTC means that if you deposit 0.1 BTC, you get an extra 0.1 BTC in bonus funds. As we’ve seen, some sites go even higher: 150%, 200%, or more in match percentage.

The welcome bonus boosts your starting bankroll, giving you more crypto to gamble with. It usually comes with wagering requirements that must be met before you can withdraw the bonus or winnings from it. Still, it’s one of the biggest draws for new players choosing the best online crypto casino to start with.

2. Free Spins

Free spins are a bonus specifically for slot players. Casinos might offer free spins as part of a welcome package or an ongoing promotion.

For example, “50 free spins on sign-up” or included with a deposit bonus. Each free spin allows you to spin the reels of a slot machine without staking your coins, but you can win real money or bonus funds from it.

Crypto casinos often tie free spins to popular slot games. Winnings are typically credited as bonus funds and may have wagering requirements. Free spins are a great way to try out slot games without risking your BTC balance.

3. Deposit Match

A deposit match bonus is the most common form of casino bonus—the casino matches a percentage of your deposit with bonus credit.

Aside from welcome deposit matches, you’ll see offers like “30% reload up to 0.005 BTC” for returning players. The match boosts your deposit amount, but remember that matched funds are bonus money, often subject to wagering requirements. Always check the percentage (100%, 50%, etc.), the maximum amount, and the terms.

A deposit match is essentially extra betting power, making it a favorite bonus type.

4. No-Deposit Bonus

A no-deposit bonus is a casino freebie you get without needing to deposit any crypto. These are less common but very attractive to players. It could be a small amount of free credit or a bundle of free spins given just for signing up or completing a certain action.

No-deposit bonuses allow you to try a crypto casino risk-free—you can potentially win real money with the casino’s funds. Of course, they usually come with conditions: higher wagering requirements and often a cap on withdrawable winnings, e.g., you can withdraw up to $100 from a no-deposit bonus win.

5. Reload Bonuses

Reload bonuses are deposit bonuses for existing players rather than new sign-ups. Crypto casinos reward loyalty by offering reloads on subsequent deposits.

For example, a 50% bonus on your second and third deposits or routine reloads like “Every Monday 40% up to 0.002 BTC.” Reload bonuses encourage players to keep depositing and playing at the same site.

VIP levels or loyalty status can often increase the percentage or frequency of reload offers you receive. Reloads might be smaller than the big welcome, maybe 30-50% typically, but they’re still valuable.

Consistently using reload bonuses can significantly boost your bankroll over time, making your crypto gambling more bankroll-efficient.

6. Cashback

Cashback or rebate is a beloved promotion in many Bitcoin gambling sites. With cashback, the casino gives you back a percentage of your net losses over a period. For example, 10% weekly cashback: if you lost the equivalent of $500 in crypto over the week, you’d get $50 back. Cashback can be credited as withdrawable cash or as bonus funds, depending on the casino.

The great thing is that it softens the blow of losses, serving as a form of insurance. Some top crypto casinos offer unconditional cashback with no wagering (essentially a refund), which is very player-friendly. Cashback rates can vary, with a common range between 5% and 15%, and VIP programs often increase cashback percentages for higher tiers.

7. VIP Rewards

VIP rewards are perks given to players who achieve VIP or loyalty status through regular play. Bitcoin gambling platforms typically have tiered VIP programs. As you wager, you accumulate points or progress that moves you up tiers.

Each tier yields better rewards: these can include higher cashback rates, special reload bonuses, priority withdrawals, personal account managers, invitations to exclusive events or tournaments, birthday gifts, and more.

Some VIP programs even have milestone bonuses. For instance, reaching a new level grants a one-time crypto bonus. Because many of the best sites for Bitcoin gambling emphasize community, VIP members often also get access to private chats or increased rain (tipped coins in chat).

8. Ongoing Promos

Crypto casinos frequently run ongoing or seasonal promotions to keep things exciting. These can include:

▪︎ Giveaways and Tournaments

Slot tournaments, leaderboard races, prize draws, and network promotions like Pragmatic Play’s “Drops & Wins,” where random prize drops occur on certain games.

For instance, a casino might have a month-long tournament where the top 100 wagerers on slot games split a 5 BTC prize pool or daily random prize drops on live games.

These ongoing promos add extra chances to win beyond your regular play.

9. Specific Promos

Some sites have niche promotions targeting certain activities. Examples include:

▪︎ Refer-a-Friend Bonuses

Get a bonus if someone you invite signs up and plays.

▪︎ Birthday Bonuses

You can get rewards like free spins or credit on your special day. These specific promos vary widely by casino; they’re fun little extras that personalize the experience.

Top 3 Crypto Casino Bonuses and Promotions

Let’s highlight three leading operators that currently offer the best bonuses and promotions for players:

Popular Types of Crypto Games

Crypto casinos offer all the classic games you’d expect, plus some that are especially popular in the crypto community. Here are some popular game types and what they entail:

Slots

Slots are the bread and butter of online gambling, and crypto slots are no different. You’ll find a vast variety, from simple 3-reel fruit machines to modern video slots with 5+ reels, hundreds of paylines, and bonus features.

Many slots on crypto platforms are identical to those in fiat ones, from providers like NetEnt, Games Global, etc.

Top crypto slots include titles like Book of Dead and Gates of Olympus. Progressive jackpot slots are also available for BTC gambling, where the jackpot can grow into millions of dollars worth of crypto, waiting for a lucky winner.

Table Games (Blackjack, Craps, Roulette, Baccarat)

Table games are classic casino games involving cards or wheels.

- Blackjack is particularly popular among crypto players, and websites offer blackjack in RNG and live dealer formats. It’s a game of skill and luck, where the goal is to get 21 or close without busting and beat the dealer’s hand.

- Other staples include roulette and baccarat. You’ll find European and American roulette variants, with most players preferring the lower house edge offered by the European version.

Baccarat tends to be favored by high rollers, who enjoy placing large wagers on the player or dealer, but there are also versions that you can play for smaller stakes. - Craps is a dice game which is less commonly found at crypto sites than other table games. Players wager on the outcome of the roll of two dice, which sounds simple, but there is a bit more of a learning curve than for casino favorites like blackjack or roulette.

Live Dealer Games

Live dealer games bring the real casino atmosphere to the online world. A live crypto casino streams human dealers conducting games in real time. You can join a live table for games like blackjack, roulette, baccarat, or even game show-style games like Crazy Time and Monopoly Live.

The dealers interact with players via chat, and the action is broadcast from a studio or actual casino floor.

The beauty of live dealer games is trust and immersion; seeing the cards being dealt or the roulette ball spinning live assures you of fairness (plus it’s just more engaging). Providers like Evolution Gaming dominate this space with high-quality streams.

Many Bitcoin gambling sites have extensive live sections, even allowing relatively high stakes in BTC for VIPs. It’s the closest you get to Las Vegas while gambling from home with cryptocurrency.

Poker/Video Poker

Poker comes in a couple of forms online. Video poker is a machine-based game (like a slot) where you’re dealt a five-card hand and choose which cards to hold or discard to make the best hand.

It’s popular because it has a relatively high RTP: if played with optimal strategy, games like Jacks or Better have ~99% RTP.

Many crypto sites have multiple video poker variants. Then there’s live poker or poker rooms: a few crypto operators offer peer-to-peer poker like Texas Hold ’em cash games and tournaments, or at least Casino Hold ’em, which is poker against the dealer.

Crash Gambling

Crash is a crypto-original game concept that has become incredibly popular. The game is simple: a multiplier starts at 1x and increases until it “crashes” at a random moment. Players stake an amount of crypto before the round starts and then must decide when to cash out during the round to lock in that multiplier on their bet. If you don’t cash out before the crash, you lose your bet.

The thrill is trying to ride the multiplier as high as possible without losing it all.

Crash games are provably fair and transparent. This game became famous on sites like Roobet, and now many crypto sites have their own original Crash games. It’s social, too; you see others cashing out, which adds to the excitement. Crash gambling epitomizes the high-risk, high-reward nature of crypto gaming.

Bingo

Bingo is a numbers game that is not always seen at every crypto site, but it exists in some, especially those with community games sections. In bingo, players purchase cards with a grid of numbers, and numbers are drawn randomly. If the numbers that are drawn form a specific pattern on your card, you win a prize.

Some operators have automated bingo draws that you can participate in at any time. Also, beyond traditional bingo, there are fast-paced crypto lottery games and keno that are quite popular. These offer quick rounds and immediate payouts. Bingo is more of a social/casual game, often with multiple players. The best operators integrate chat features in crypto bingo, making it a fun group experience like you would have at a traditional bingo hall.

Dice Games

Dice games hold a special place in crypto gambling history. Bitcoin Dice was one of the first provably fair games. The concept is that you choose a number, and the game will generate a random number between 0 and 100. If the result is below your chosen number, you win.

You can also find dice games where you put money on the outcome of a physical dice roll or combination. But the quintessential crypto dice is the sliding scale “hi-lo” dice. It’s extremely fast and often allows betting to 1 decimal of a cent, making it popular for both micro-betting and high rolling.

Lottery

Lotteries are games of pure chance where winners are drawn from tickets or numbers. In crypto gambling, you might see lottery-style games such as weekly draws, where you buy tickets with crypto for a jackpot. Some operators host their lotteries, and there are also blockchain-based lotteries.

Another angle is that some websites call keno or number draws “lottery.” Keno is like a lottery: you pick a set of numbers, and a certain amount is drawn; the more of your numbers that hit, the more you win. These games give players a shot at large payouts from small bets, though the odds are long, akin to national lotteries.

Top 10 Bitcoin Gambling Software Providers

Behind every great casino game is a software provider. Here are the top ten Bitcoin software providers whose games you’ll frequently encounter on cryptocurrency gambling sites. Primarily focusing on slots and table games:

How-to Guides

Getting started with crypto gambling may seem daunting if you’re new to cryptocurrency. Below is a quick guide covering the basics—buying crypto, setting up a wallet, funding a casino account, and withdrawing winnings.

Registration & Play

Follow these steps to register at the casino and begin playing:

- Choose the Crypto Gambling Site

- Complete the Sign-Up

- Pass the KYC Process

Every casino has its unique steps; many support one-click registrations through Google or just with an email and password. Some casinos may not require the KYC procedure, but you can prepare and submit the necessary documents in advance when needed.

How to Buy Crypto?

Buying crypto is quite straightforward these days. Here’s an example using Coinbase, a popular crypto exchange:

How to Set Up Your Wallet

Once you have crypto, it’s best to store it in a personal wallet, especially if you’re going to send it to a casino or hold it for a while. You have two main types of crypto wallets:

1. Software Wallet (Hot Wallet)

This is a mobile or desktop app that holds your crypto. For example, Trust Wallet or Exodus are user-friendly for beginners.

- Download the app and follow the setup prompts.

- A new wallet will be created and will present you with a recovery seed phrase. Write these words down on paper and keep them safe. This is the backup to recover your wallet if you lose your phone. Never share this phrase.

- Once set up, Trust Wallet will give you addresses for various cryptos. For Bitcoin, you’ll have a BTC address. You can receive BTC here from Coinbase by sending it to this address.

Software wallets are convenient and free. They are connected to the internet (so-called “hot”), which makes them very handy for daily use, though they are slightly less secure than hardware wallets.

2. Hardware Wallet (Cold Wallet)

A hardware wallet like Ledger Nano or Trezor is ideal for larger amounts or long-term storage. It’s a physical device that stores your private keys offline.

- To set up a Ledger, buy one from the official source (avoid third parties to prevent tampering). Plug it into your computer and install the Ledger Live software.

- Initialize the device: choose a PIN and write down the 24-word recovery phrase it provides. Again, store this phrase securely off-site.

- In Ledger Live, add a Bitcoin account. This will allow you to generate receiving addresses.

Hardware wallets sign transactions internally, meaning your private keys never leave the device. Even if connected to a malware-infected computer, the hacker can’t extract your keys, making it extremely secure.

Use the hardware wallet to confirm any transaction you send. For Bitcoin gambling purposes, you might transfer from your Ledger to a hot wallet for convenience or even directly to a casino if you trust your operations. But typically, hardware is for holding, and you’d use a software wallet for frequent transactions.

Crypto Wallets We Recommend

- If you’re starting, Trust Wallet or Exodus are great for multi-cryptocurrency support and ease of use.

- For hardware, Ledger Nano S/X or Trezor Model One/T are industry standards to keep your funds ultra-safe.

How to Transfer Funds to Casino Sites?

Now that you have crypto in your wallet, you’re ready to deposit at the casino. Here’s how, using an example casino from our top list (say, Betpanda):

Is Crypto Gambling Safe?

The answer is yes, crypto gambling can be safe, provided you take certain precautions and use reputable platforms. The underlying technology, blockchain, actually enhances security in many ways.

Blockchain transactions are transparent and immutable, so you can verify that your deposit went through or that a game outcome was provably fair. Bitcoin gambling platforms implement robust site security: SSL encryption to protect your data and two-factor authentication (2FA) to secure account access.

To ensure you’re in the right place, stick to well-known and licensed crypto casinos. A licensed site has regulatory oversight requiring fairness and anti-fraud measures. Additionally, confirm the casino uses provably fair algorithms for its unique crypto games.

Best Provably Fair Casinos

The best provably fair casinos use cryptographic algorithms to prove that game outcomes are fair and not manipulated.They typically offer games like dice, crash, coin flip, Plinko, mines, and other simple chance games where provable fairness is easiest to implement.

Responsible Gambling

No matter where or how you gamble, practicing responsible gambling is vital. The anonymity and speed of crypto can make it easy to lose track of spending, so it’s important to set personal limits and stick to them. Always remember: gambling should be seen as entertainment, not a way to consistently profit or solve financial issues.

Here are some responsible gambling tips tailored for crypto players:

1. Set a Budget:

Decide how much crypto you’re willing to risk in a session or week, and don’t exceed that. Perhaps you allocate 0.01 BTC for the weekend fun—if it’s gone, it’s gone; don’t chase with more.

2. Time Management:

It’s easy to get caught up. Set time limits for your gambling sessions. Take regular breaks. Crypto markets run 24/7, and so do crypto casinos; that doesn’t mean you should play 24/7.

3. Use Casino Tools:

Many of the best Bitcoin casinos provide responsible gaming tools like deposit limits, loss limits, wager limits, or cooling-off periods. Use them. For instance, you can often set a daily deposit cap in your account settings. It’s a great way to enforce your budget.

4. Recognize Signs of Problem Gambling:

If you find yourself anxious, gambling to recover losses, or if it’s impacting your daily life, it’s time to step back. The emotional rollercoaster can be a sign things are getting unhealthy.

5. Don’t Gamble Under the Influence or Emotional Distress:

It’s a recipe for poor decisions. Keep a clear head. Also, avoid gambling when extremely upset or stressed, as you might make irrational bets seeking a quick fix.

6. Only Gamble What You Can Afford to Lose:

This age-old rule is even more pertinent with volatile crypto. Only play with funds that won’t affect your livelihood if lost. Treat any crypto you deposit as already spent on entertainment.

7. Self-Exclude if Needed:

If you feel things are out of control, don’t hesitate to self-exclude. Crypto casinos have options to disable your account for a set time or permanently. You can also seek support groups or hotlines specialized in gambling addiction.

Conclusion

Crypto and Bitcoin casinos have revolutionized the online gambling scene, offering privacy, fast transactions, and global access that traditional casinos can’t match. We’ve explored the best Bitcoin gambling sites of 2025, each with its own strengths, from huge bonuses and VIP perks to provably fair games and cutting-edge features.

The key to a great experience is choosing a reputable, secure casino that fits your needs, whether you prioritize anonymity, game variety, or high-roller rewards.

If you’re ready to jump in, consider starting with one of our top picks. Take advantage of those welcome bonuses. Explore different game types – maybe try a few rounds of provably fair dice or join a live blackjack table with BTC.

New Casinos

The casino scene is booming with new cryptocurrency casinos popping up regularly. These new operators often bring fresh features, bigger bonuses, and innovative ideas to stand out. However, these casinos have yet to build an established reputation, so players should exercise additional caution when signing up and depositing with crypto.

Why use Bitcoin and crypto for online gambling?

Using Bitcoin or other crypto at online casinos offers greater privacy, faster transactions, and lower fees.

You don’t have to share sensitive banking details, and you can gamble anonymously with just a wallet address.

Where is the best place to gamble crypto?

The best place is at a licensed, reputable crypto casino with a strong track record and games you can enjoy.

In our guide above, we reviewed the top options—for example, Lucky Block, BC.Game, and Betpanda are excellent choices.

These sites have large game libraries, fast payouts, and generous bonuses.

Are crypto gambling sites legal?

The legality of this site depends on your jurisdiction. The sites themselves are often licensed in crypto-friendly jurisdictions, which makes them legitimate from a licensing standpoint.

In many regions, online gambling with crypto exists in a gray area—not explicitly illegal, but not regulated locally either—and it’s a good idea to check what your local laws and regulations are before signing up.

Do you pay taxes on crypto winnings?

Yes, in most countries, you must pay taxes on crypto winnings just as you would on other gambling winnings or income. Cryptocurrency is treated as property or a financial asset by many tax authorities.

This means if you win a significant amount of crypto from gambling and then either cash it out to fiat or even if it increases in value, that could be a taxable event.

Do crypto gambling sites charge withdrawal fees?

Typically, crypto gambling sites do not charge withdrawal fees on their end. One of their advantages is actually that they usually let you withdraw for free, unlike some fiat casinos that might impose a bank withdrawal fee.

What is the best Bitcoin wallet for gambling?

The best wallet for gambling is one that balances security and convenience.

Consider Trust Wallet, a free mobile app that supports Bitcoin and many other cryptocurrencies.

If you’re dealing with larger amounts or want top-notch security, a Ledger Nano S or X is excellent.

How do I avoid scams on crypto gambling sites?

Only by using reputable casinos. Always check their licensing and real user reviews.

How do I know if a crypto gambling site is fair?

To confirm fairness, check for a provably fair and RNG badge. Also useful are licensing details, which should always be at the footer.

Which are the best Bitcoin gambling sites without withdrawal limits?

From our list, a few standouts are Stake.com, Betpanda, and BC.Game.

What is the best BTC gambling website for US players?

Legally speaking, US players have a limited selection because of regulations, and based on accessibility, game variety, and reputation, some of the top choices are Stake.us, BetOnline, and BC.Game.

Cryptocurrency Casinos

A pro writer since 2015, immersed in the world of crypto since 2016, Will built up a wealth of knowledge and experience in both crypto gambling and crypto betting, making him one of the most prominent voices in the industry. His high-quality reviews have been featured on prominent gaming platforms, making him a trusted authority in the field.

Nationality

British

Lives In

England

Facts Checked by Josip Putarek

Fact checked by

Fact checked by

will.wood.9964@gmail.com

will.wood.9964@gmail.com